5 Things to Do Before Buying an Overseas Investment Property

You might have been on holiday and fallen in love with another nation’s cuisine, customs, and way of life, or you simply could be looking for that prime opportunity to invest. While purchasing overseas real estate offers an excitement of its own, don’t do it without doing your homework—but more so with the involvement of a professional. International markets sometimes make sense for a real estate investor who wants to expand his portfolio and ride good market waves. However, buying too hastily will get you into much trouble, get you stuck with a big tax bill, and leave you struggling to find long-term tenants. There are some affairs you should have in order prior to picking up the keys to your first, or next, international investment property.

Here are five things to do before buying your Overseas Investment Property:

Get the right facts

Conduct thorough market research

Notably, it is crucial to have adequate knowledge of the new country’s real estate market before going deep into the purchase of an overseas property. This includes assessing market forces such as trends in the property market, the value of the property, the yields that are expected to be generated from the property, and economic forces that may affect your investment.

According to our opinion, the primary concept is to collect valid information from recognized sources. For example, newspapers, journals, magazines, local real estate agencies, government publications, and firms dealing in market analysis can be useful.

It’s also crucial to understand the rental market if you’re planning to let out your property. What kind of rental yields can you expect? Are there particular types of properties that are in high demand among renters?

Here’s a quick checklist to guide your research:

- Historical price trends

- Current market conditions

- Future development plans for the area

- Rental yields and occupancy rates

- Types of properties in demand

The economic & political stability

Make sure you invest your money into a country where economic and political culture is relatively stable. Examples are growth rates of Gross Domestic Product, inflation rates, and government policies toward foreign investment. It can be detrimental to your investment when the country of your choice has had its fair share of political and/or economic upheavals.

Visit the location

Engage with local experts

It is recommended that a property investment buyer’s agent be hired who will be more knowledgeable about the area. They can influence the decision of the best area to invest in, potential dangers, and legal specifications. Also, they can assist in obtaining better terms and conditions or to handle its management for you.

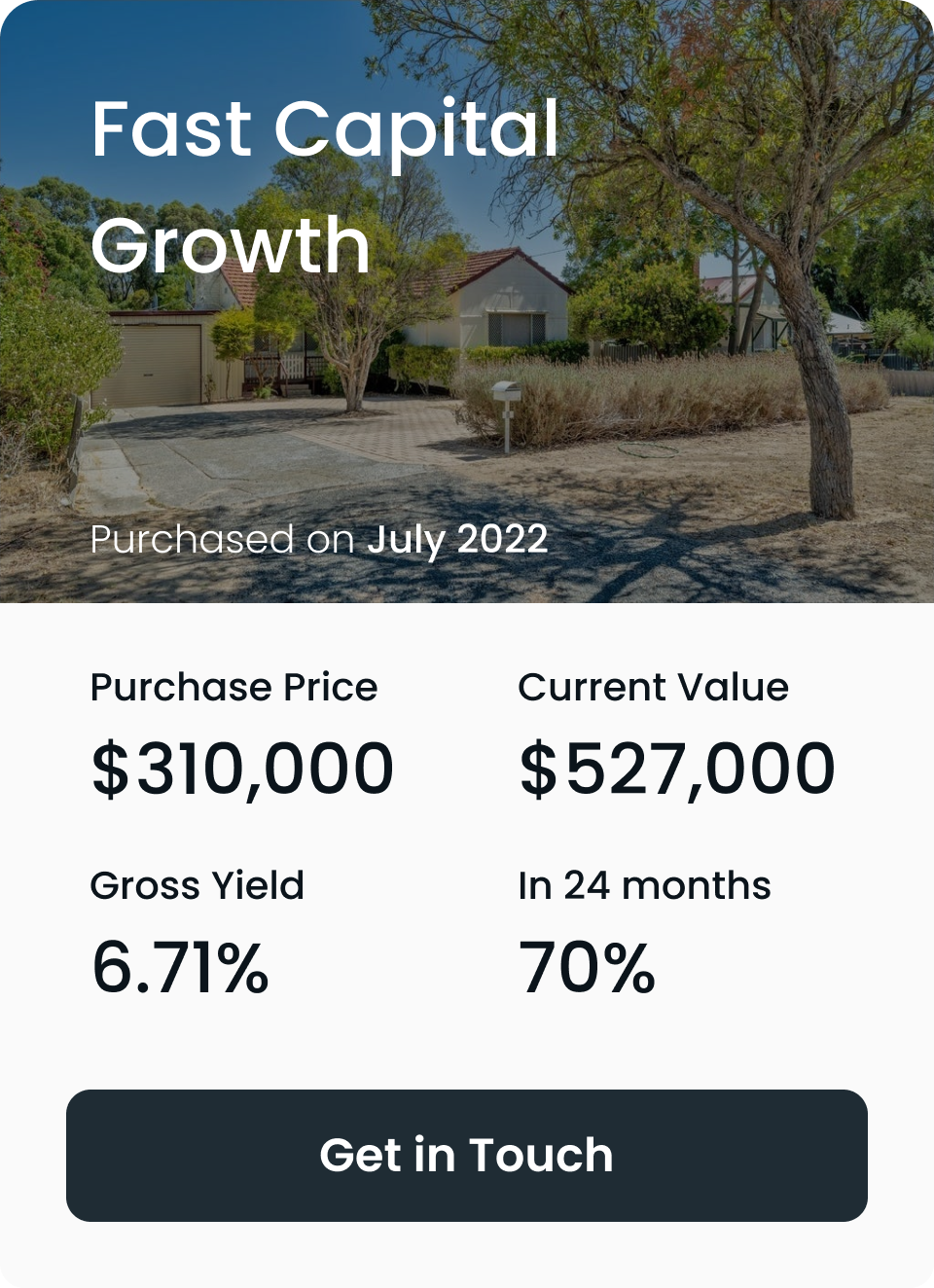

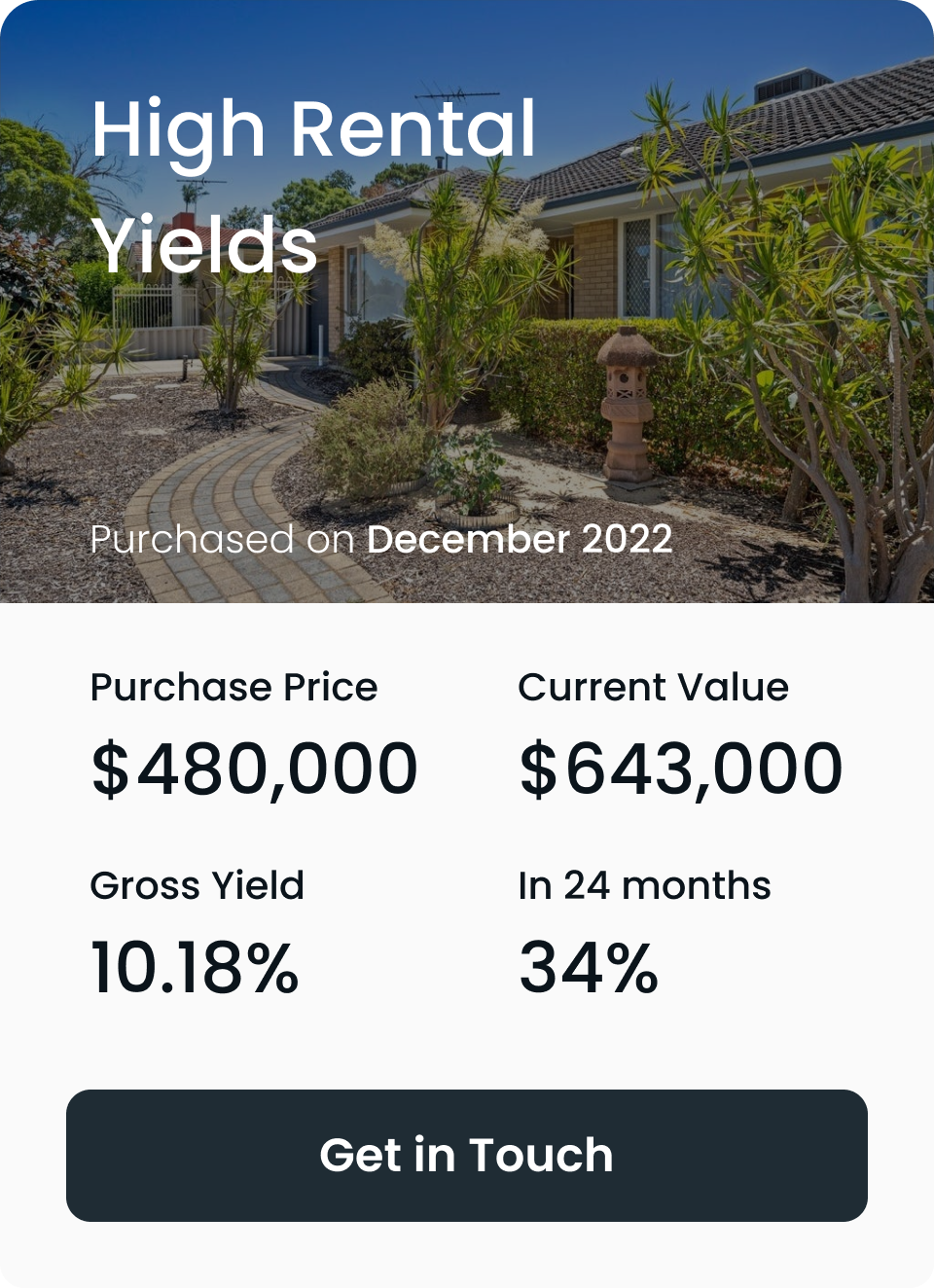

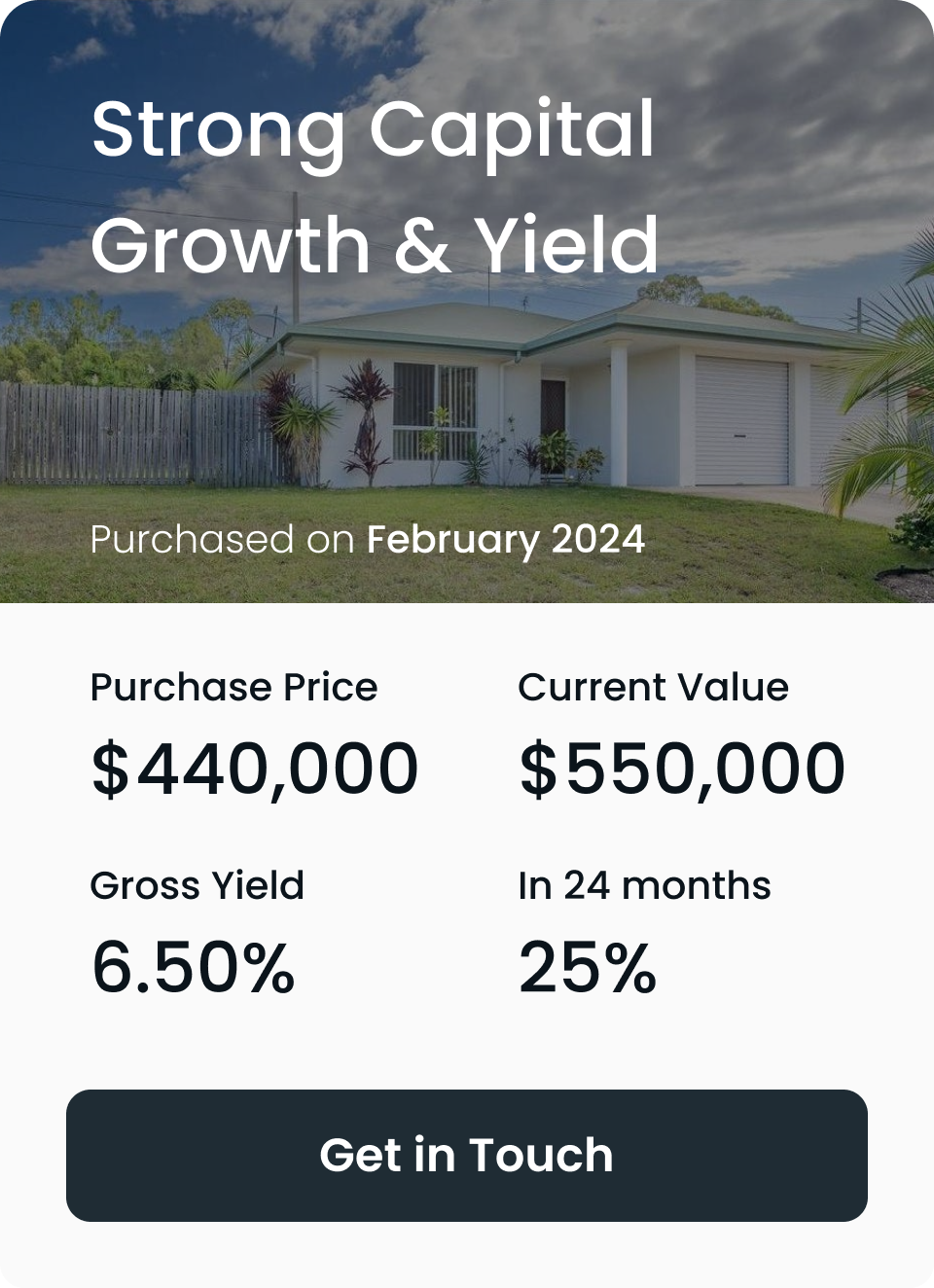

Do you have $85,000 saved in cash or equity?

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

Do you have $85,000 saved in cash or equity? Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Understand legal requirements and tax implications

Familiarise yourself with local laws

Always keep in mind that even foreign real estate investors are subject to the laws and regulations of every country. While many places have strict rules that may make it hard to buy an investment property, with Australia, they actually welcome those foreign investors who give them the opportunity to create economic growth and develop jobs for the country. This also includes an important requirement: foreign investors have to acquire approval from the FIRB before purchasing property in Australia.

It is in this respect, stipulated by Australian property law, outlining the kinds of properties that foreign investors can and cannot buy. Generally speaking, foreign investors are restricted to buying either newly constructed homes or undeveloped land in Australia (unless they are buying an existing home with the intention of demolishing it and building numerous new homes on the same lot).

Consult a legal expert

The most crucial step in buying real estate abroad is to retain the services of a local attorney before making any financial or bureaucratic commitments. Get a local lawyer who specializes in real estate to save you from the traps. They can guide you through the legal minefield, ensure you comply with all the rules and protect your investment interests.

Tax implications

There is tax, which is pretty important in property investment. It varies from country to country with capital gains tax, rental income tax, and even inheritance tax. Without saying that there may be some home country taxation responsibilities, then it shall be good to seek a tax advisor familiar with international property investment to assist you in tax planning.

Double taxation treaties

Secure financing and manage currency risks

Changing investment in property will require significant financial investment, so it’s important to plan how you will fund your purchase. It’s not normally too difficult to arrange a home loan as a citizen or permanent resident, but foreign investors, in particular, have a tough time. Most banks and lenders in Australia require that their mortgage loans be made to Australian citizens or permanent residents. There are still a few options for foreigners, though.

Loan options for foreign investors

- 30% Deposit: Prepare a 30% deposit for a property in Australia, and some lenders will lend to you at an interest rate of 6.5-8% per annum.

- 45% Deposit: You can obtain a rate as low as about 5% with a 45% deposit or more, although you must be well-qualified by net worth, and take your primary currency in Canadian, British pounds, or U.S. dollars.

- Residency or Marriage: You can borrow more at a reduced interest rate if you reside in Australia or marry an Australian citizen.

Other funding options

If you cannot secure bank finance, the following are the other options for funding of your property investment:

- Home Equity: You can give yourself a line of credit for the next investment through the equity in your current home or refinance an already existing loan.

- Capital or Savings: Especially when buying a rental property in a low-cost area, it is highly applicable to use your capital to buy a straight-out property or your own dollar savings.

- Working with a Mortgage Broker Many investors choose to use a mortgage broker when investing in overseas markets, such as Australia. A local finance expert can then tailor his advice to the best possible means of funding your property investment and sourcing the loan options available to you.

It may overcome the challenges related to securing of loan as a foreign investor by exploring financing options and professional advice to make reasonable investment decisions in property investment in Australia.

Understand currency exchange risks

Currency exchange rates may both dramatically affect your investment returns and be very unpredictable. If the exchange rate changes, then your purchasing power, the size of your mortgage payments, and even the rental income might change. We recommend that you work with a financial advisor who can guide you through the process of managing currency risks and potentially hedging against unfavorable movements in the exchange rate.

Budget extra

While purchasing an overseas property, a number of other fees need to be considered, which include legal fees, property taxes, insurance, and maintenance costs. Ensure you have a comprehensive budget that factors in all these. Better to overestimate your budget rather than get any financial surprises.

Consider remittance costs

This can run into large amounts, especially when you are transferring the money overseas. Research and compare remittance services, such as who has the cheapest rates. Some banks and financial institutions provide more competitive exchange rates and lower transfer fees, especially for larger transactions.

Plan for property management

Decide on property management

It could be very cumbersome to manage an overseas property, especially if you happen not to be based in the same country yourself. At quite an early stage, it may be quite significant to decide whether you will manage the property by yourself or engage the services of a property management company.

Benefits of hiring a property management company

There are several reasons why hiring a property management company can be of help. They can get involved with tenant inquiries, maintenance issues, and collection of rent and see that the polarization of the property adheres to local regulations. All of these can take much time from you and alleviate a lot of stress.

Choosing a property management company

Regular inspections and maintenance

Keeping your property well-maintained is very important, not only for looking after it but also for monetary reasons. Ensure that the manager keeps you updated with regular reports and inspection reports in regard to your rental property. Also, a budget for ongoing maintenance and other surprise repair costs should be set aside.

Understand your investment goals and exit strategy

Define your investment goals

Before investing in an overseas property, one needs to clearly specify what his or her goals are. Are you seeking rental yield or capital appreciation, or both? It will give a relevant clue into deciding the type of property to be bought and the location to invest in.

Short-term vs. Long-term investment

Develop an exit strategy

As much as an entry strategy for a property is role crucial, so is the exit strategy. Decide on the amount of time you want to stay in the property and under what condition to sell. An exit strategy allow one to be focused on the investment so that one does not end up acting impulsively over their asset.

Monitor the market

Be aware of the market condition and economic factors that might likely impact your investment. Keep yourself updated about local real estate markets along with the conditions, changes in interest rates, and economic policy changes, so proper decisions can be made at the right time for your investment.

Re-evaluate your investment from time to time

It is important to check your investment once in a while to ensure that it is really on course with regard to your goals. Check out the performance of the property, the rental income, and the value of the market. If the investment targets aren’t met, then adjust the strategy or sell the property.

At The Investors Agency, we find you...

The best returning properties that your portfolio needs.

WHAT OUR CLIENTS THINK OF US

Matt Clarke2024-08-04My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency.

Matt Clarke2024-08-04My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency. Gaurav Saxena2024-08-04Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth.

Gaurav Saxena2024-08-04Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth. Matt Lav2024-07-17This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon!

Matt Lav2024-07-17This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon! Ben Killen2024-07-07An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably.

Ben Killen2024-07-07An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably. Ryan Johnston2024-06-24We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property.

Ryan Johnston2024-06-24We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property. DJBors Channel2024-06-24Awesome and straight forward . Efficient!!!! TIA is the best!!!!

DJBors Channel2024-06-24Awesome and straight forward . Efficient!!!! TIA is the best!!!! Rahul Ramachandran2024-06-09working with Josh was a good experience. Highly recommend them with your property goals.

Rahul Ramachandran2024-06-09working with Josh was a good experience. Highly recommend them with your property goals. joseph karipel2024-05-31It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more

joseph karipel2024-05-31It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more