10 Tax Deductions Every Property Investor in Australia Should Know

Real estate provides a promising way for long-term financial growth. However, the temptation of potential returns often overpowers the real importance of real estate investing: tax considerations. An informed investor recognizes that as property appreciates substantially, so does tax implication, greatly affecting the bottom line of an investment.

Knowing your tax deductions available to property investors in Australia may swing your investment return in an advantageous direction. So, if you are a property investor in Australia, stay alert for these widely known tax deductions to plan your investment.

What are tax deductions on properties and how do they help investors?

A tax deduction on properties is the allowable expense that property investors may claim to reduce their taxable income. These deductions, therefore, are the costs incurred in managing, maintaining, or improving an investment property. The Australian Taxation Office allows several permits for a property investor to make available their range of deductions, which can consequently enhance the profitability of property investments.

The reduction of taxable income translates to more cash available for other expenses or investments for the property investor. Rental income can be offset by claiming allowable deductions, which improves the net return earned from the property. Tax benefits make property investment more attractive and encourage investors to hold properties for more extended periods. Deductions help reduce these costs, such as maintenance and loan interest, thus easing the pain of ownership.

10 tax deductions every property investor must know

Loan interest

Depreciation

Depreciation is a non-cash deduction you can claim due to the wear and tear attributed to assets within your property, such as appliances, fixtures, and the building. There are two kinds of depreciation available:

- Equipment Depreciation This is made up of carpets, ovens, and air conditioners.

- Depreciation on Capital Works: This means the structure of a building and fixed items such as walls, roofs, and doors.

Fees on property management

You can hire a property manager for your rental property to save yourself time and distress. Luckily, these are all tax-deductible. This would include the cost of dealing with tenants, inspection charges, and even the coordination of maintenance. If you use an agency to advertise your property or do tenant screening, those also apply.

Repairs and Maintenance

If you incurred expenses in repairing damages or preserving the state of your rental property, those expenses may be allowed as deductions. In repairing, you must restore something to its previous state; for instance, repair of a broken window or leaky pipe. You can also claim servicing air conditioning units and repainting as maintenance expenses. Repairs are deductible straight away, whereas improvements made to add value to the property are capitalized and recovered through depreciation over time.

Negative Gearing

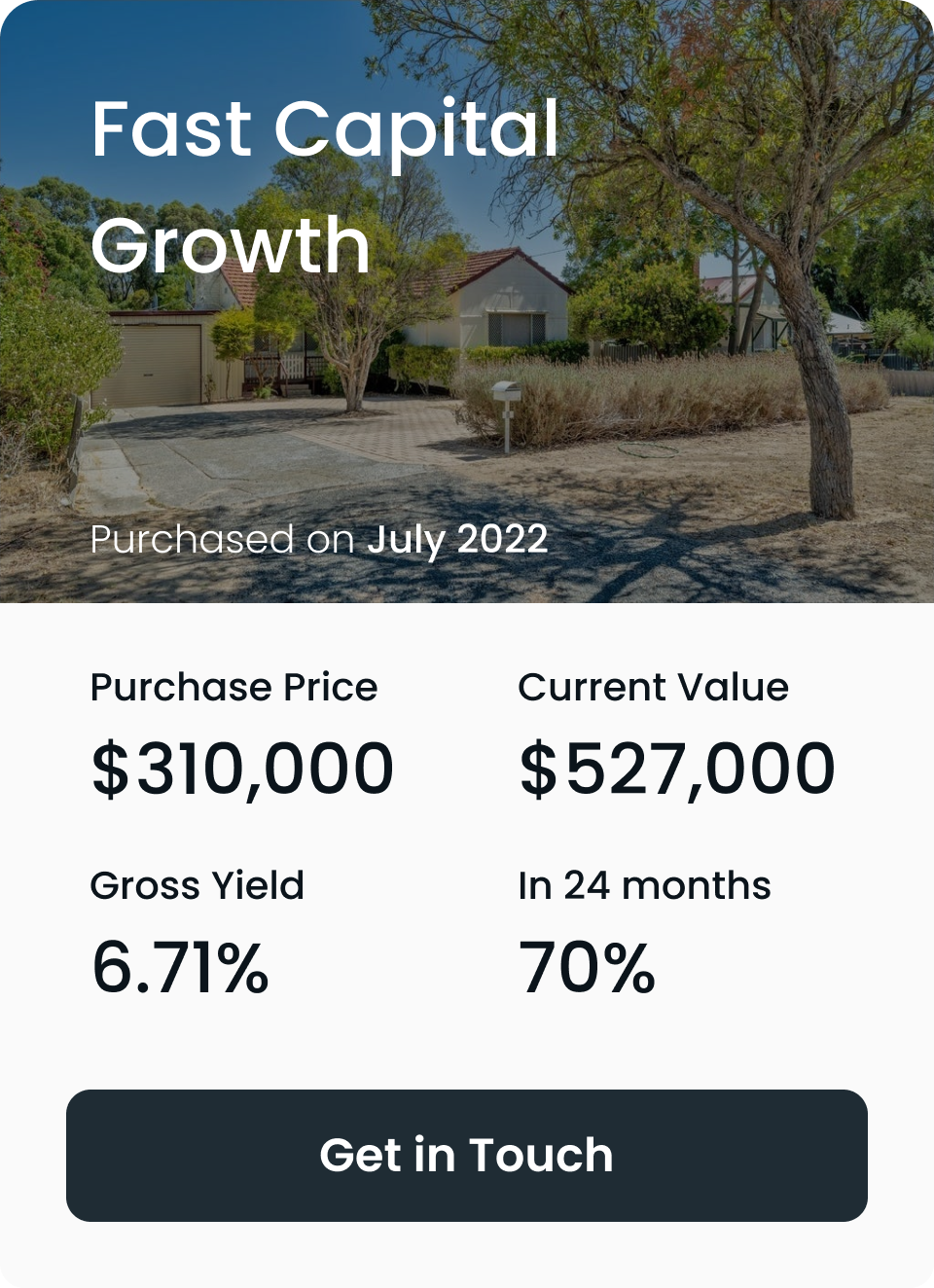

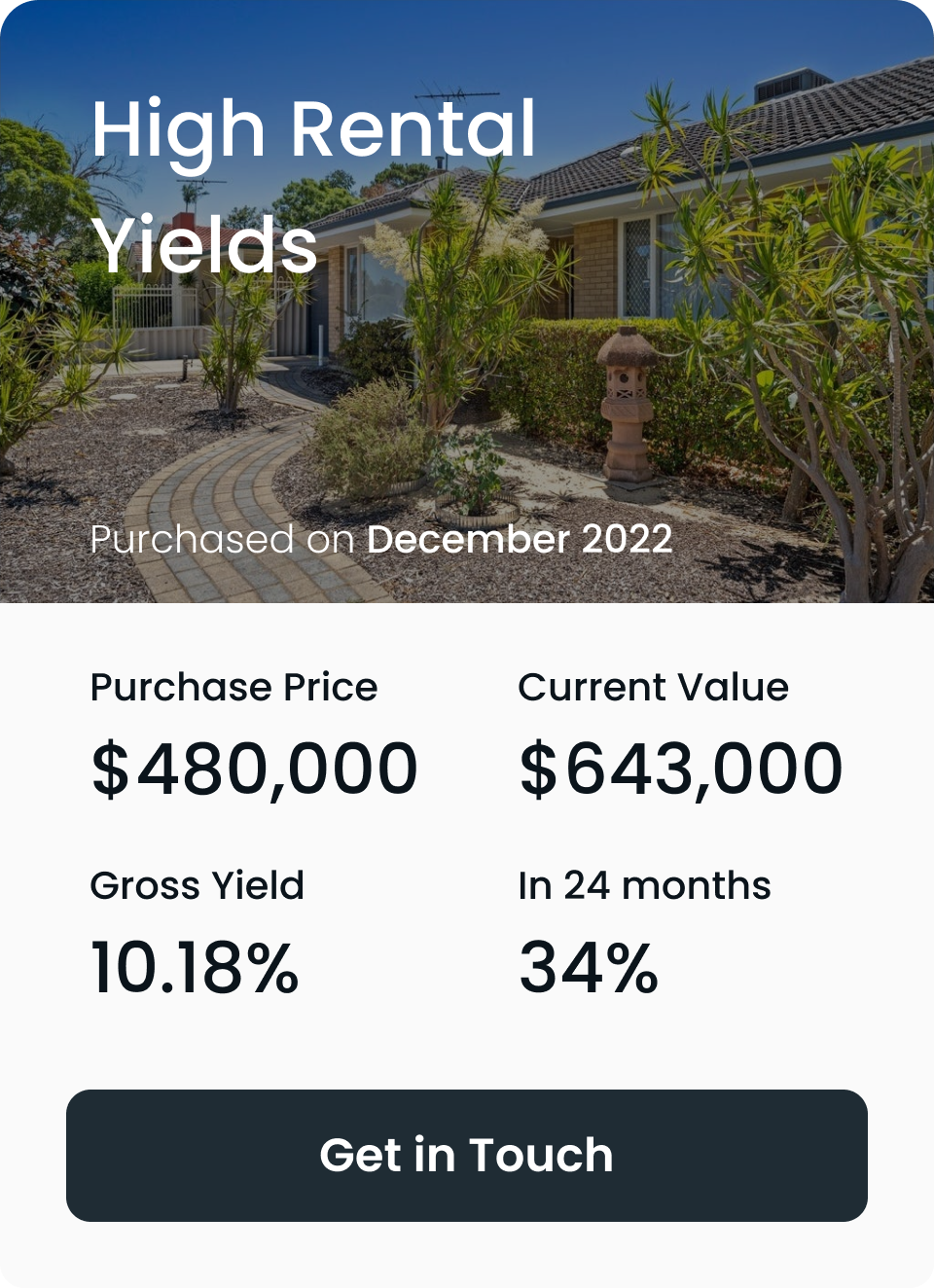

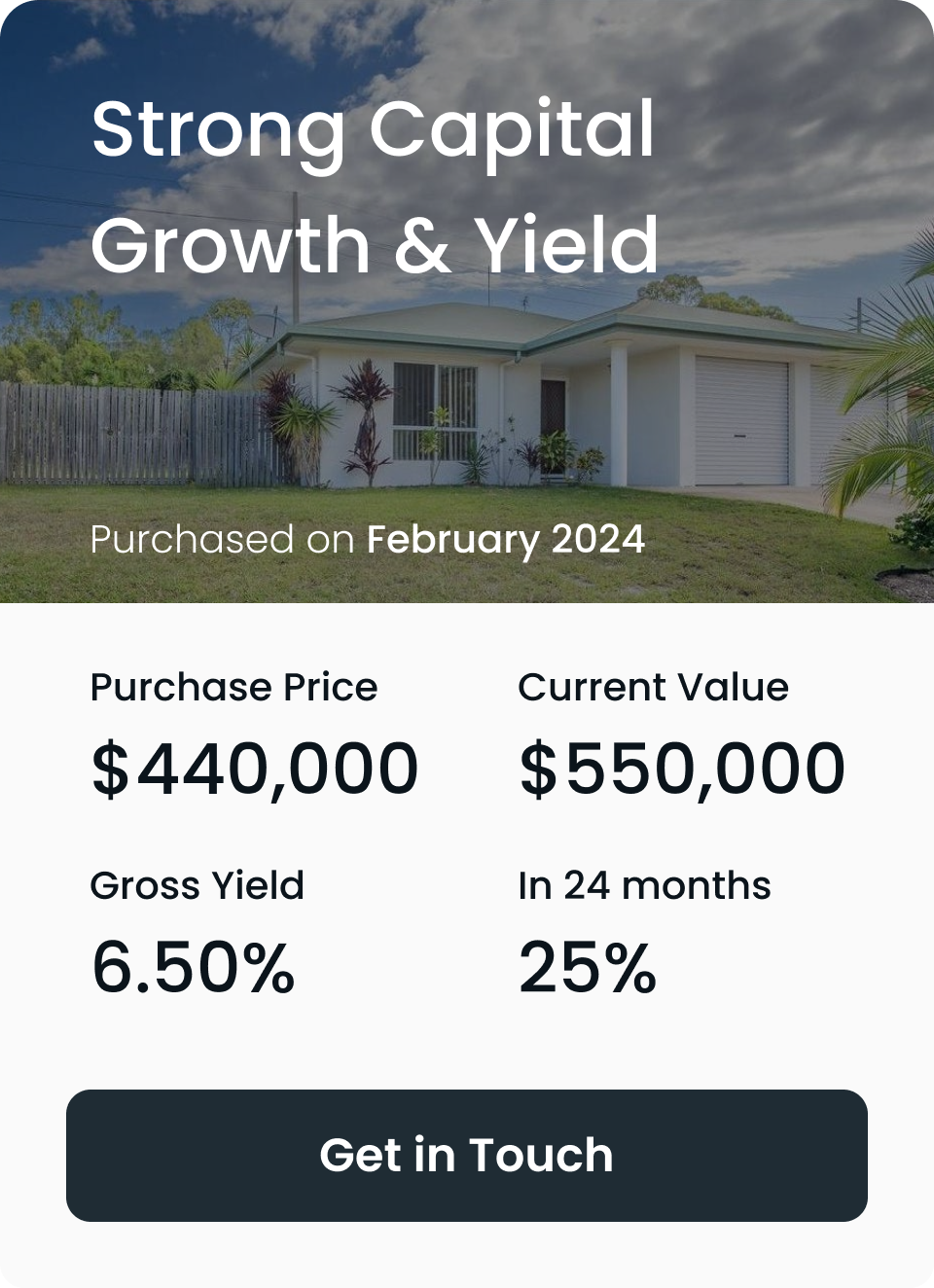

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Insurance

For investment properties, premiums paid for insurance are deductible. Such policies include building insurance, landlord insurance, and public liability insurance. In the face of risks such as rental default or damage to property caused by the tenant, for instance, an important cover would be the landlord insurance. But be sure that such a policy applies to investment properties to qualify for the deduction.

Capital gains tax (CGT)

There are those tax duties that apply in cases where an investment property is sold for a profit. Capital gain tax applies, which in this case is the difference between the selling price and the cost base of the property. However, Australian property investors can reduce their liability regarding CGT through deductions. For properties held more than 12 months, investors are entitled to a 50% CGT discount, meaning they only pay tax on half of the capital gain.

Legal and professional fees

Advertising costs

Full and immediate tax deductibility of the costs of advertising the letting of your property; these may include placing an advert on a real estate website, newspaper ads, and professional photography fees. Effective advertisement thus minimizes vacancy periods, which is a win-win for both parties.

Council rates and utilities

How tax deductions shape a country's financial health?

Tax deductions do not only benefit the individual investor but also are very instrumental in strengthening the economy of a country. It encourages investment in properties or other economic activities, hence stimulating growth in certain sectors such as construction, real estate, and infrastructure. Investment in housing with the help of these deductions helps to cover any shortages in supply in housing, creates employment, and increases businesses in specific areas.

Besides, better management of rental property often results from tax write-offs for property investors. This will directly enhance the level of tenant living standards and greatly aid urban development. The tax savings enable investors to reinvest in their properties or other ventures, thereby strengthening economic stability and expansion of a country.

Final thoughts

Proper documentation is essential for claiming these deductions. Maintain accurate records of all expenses, including invoices, receipts, and contracts. You can maximize your deductions and adhere to the tax law by ensuring you involve a tax professional experienced with property investment.

Understanding these ten deductions will effectively help property investors in Australia reduce their taxable income and increase the returns. By leveraging them correctly, the deductions can be used to turn property investment into a highly profitable concern.

Frequently Asked Questions

Can I claim tax deductions for a property that isn't rented out yet?

Yes, if the property is truly listed and available for rent, expenses incurred during this period, such as interest on loans, and maintenance, can still be claimed as tax deductions.

How do depreciation schedules help property investors?

Are renovations tax-deductible?

Do Australia have tax deduction for negative gearing?

Yes. The losses incurred can be deducted from other income sources, thereby reducing overall tax liability of the investor.

At The Investors Agency, we find you...

The best returning properties that your portfolio needs.

WHAT OUR CLIENTS THINK OF US

Trustindex verifies that the original source of the review is Google. My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency.Trustindex verifies that the original source of the review is Google. Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth.Trustindex verifies that the original source of the review is Google. This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon!Trustindex verifies that the original source of the review is Google. An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably.Trustindex verifies that the original source of the review is Google. We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property.Trustindex verifies that the original source of the review is Google. Awesome and straight forward . Efficient!!!! TIA is the best!!!!Trustindex verifies that the original source of the review is Google. working with Josh was a good experience. Highly recommend them with your property goals.Trustindex verifies that the original source of the review is Google. It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more