11 Common Property Investing Mistakes You Need to Avoid

Investing in belongings can be a lucrative task, but it’s no longer without its pitfalls. Whether you’re a seasoned investor or simply starting out, knowing about the unusual mistakes that plague the real-estate marketplace can prevent from pricey mistakes and assist you in constructing a successful portfolio. Let’s dive into the arena of belongings investment and discover the missteps you may need to steer clear of for your journey to financial freedom.

Skipping the research phase

You can’t hold a dog responsible for consuming your homework in the world of rental houses! You’re fooling yourself if you cut corners with your research.

We understand that doing a thorough investigation might be time-consuming, particularly if you’ve been eyeing several rental properties for a while, but it’s necessary to prevent purchasing a subpar investment property.

Why research matters

Property investment isn’t always a sport of danger; it is a strategic pass requiring a stable knowledge base. Here’s why skipping research is a recipe for catastrophe:

- You may overpay for a property in a declining location

- You should leave out considering upcoming infrastructure projects that increase asset values

- You might not understand the local rental marketplace, leading to unrealistic expectations

To avoid this error, spend time analyzing market trends, suburb profiles, and economic signs. Chat with local real property marketers, attend belongings seminars, and don’t forget to consult belongings funding strategists who can provide valuable insights tailored to the Australian marketplace.

Starting your research off

The following enquiries can help you get your research going:

- Are there any planned construction projects in the surrounding area?

- Does the property have any issues, like termites or other pests, or is it close to a flood zone?

- Why is the home’s owner selling it?

- Are places like hospitals, shops, and schools close by?

Every choice you make, from assessing financial records to evaluating assets and analysing market trends, should be supported by solid facts. Ignoring these processes can result in expensive errors and lost opportunities.

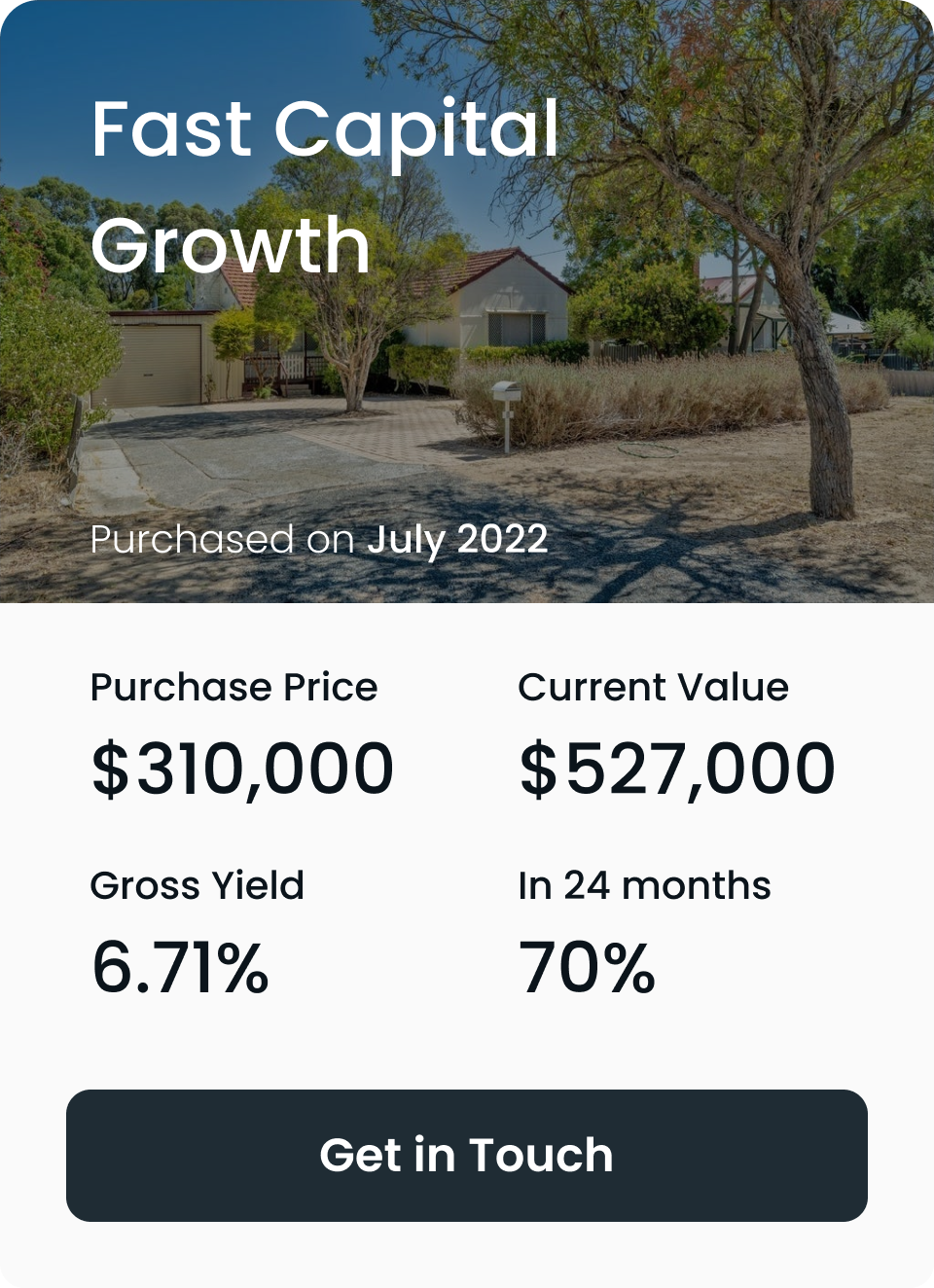

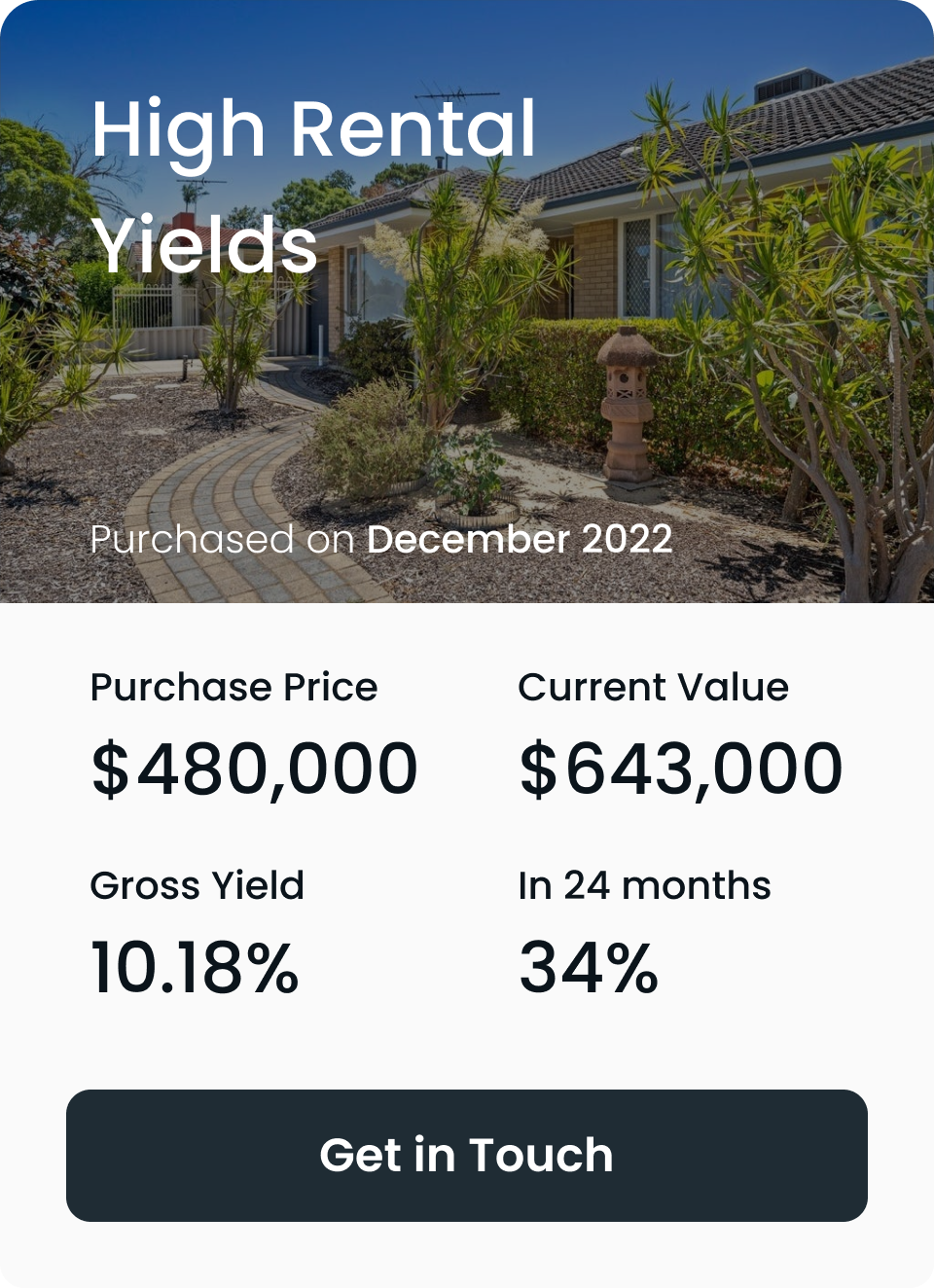

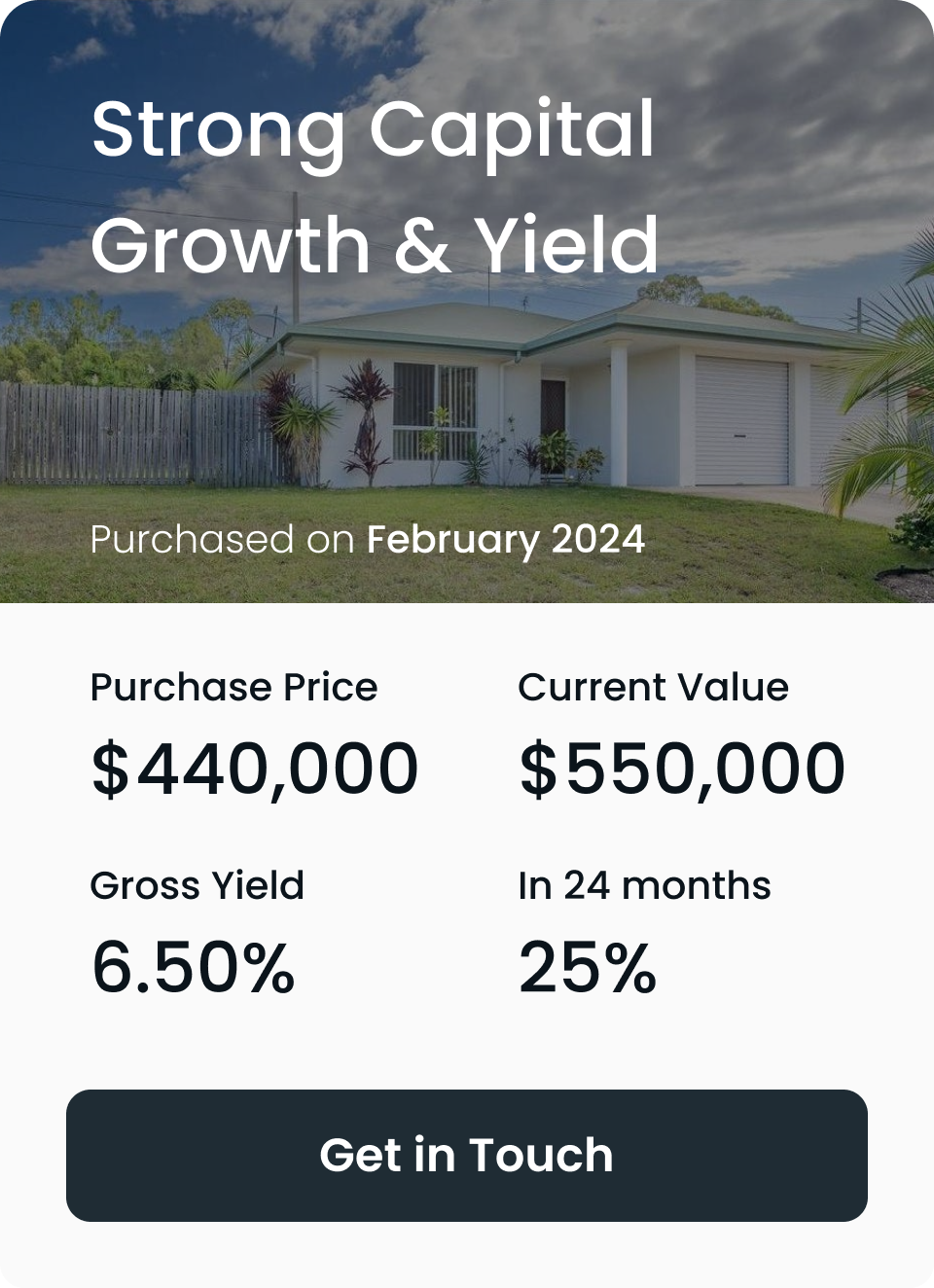

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Ignoring the importance of location

Pinpointing prime positions

When evaluating places, take into account:

- Proximity to services (colleges, stores, public transport)

- Local employment possibilities

- Future improvement plans

- Historical capital boom rates

Remember, a bargain belonging in a less-than-ideal region may turn out to be costing you more in the end via poor rental demand or a slow capital boom.

Poor financial planning and management

Effective monetary planning is important for keeping sustainable belongings investments. Mismanaging your price range can lead to cash float troubles and jeopardise your funding.

Financial planning involves more than just securing a loan. It requires careful budgeting for purchase expenses, ongoing expenses, and surprising upkeep. Understanding your monetary limits and making plans as a consequence ensures long-term profitability.

An assets’s ownership entails extra costs further to the acquisition rate. There are several expenses to recollect, ranging from coverage and assets taxes to renovation and repairs. Your investing desires may be derailed in case you don’t price range for those costs. if you don’t budget for these costs. In order to prevent future financial distress, always prepare for the unexpected.

Underestimating maintenance costs

Maintenance is an ongoing cost that many investors overlook. Neglecting those expenses can reduce your returns and devalue your own home.

Property protection entails ordinary renovation to hold the property’s condition and beauty to tenants. Budgeting for these charges is crucial to keep the assets’s fee and keep away from high-priced upkeep down the line.

Budget for the long haul

Be certain to comport in:

- Council fees and strata charges

- Insurance charges

- Regular upkeep and maintenance

- Property control expenses

- Potential durations of emptiness

By expecting those charges, you’ll be better prepared to manipulate your coin drift and keep away from nasty surprises down the track.

Failing to diversify your property portfolio

Diversification is a method to unfold hazards across unique investments. A lack of diversification can make you liable to marketplace fluctuations.

Diversifying your portfolio means investing in numerous forms of houses and locations. This method reduces the hazard associated with marketplace adjustments and allows to stabilise your earnings streams. A diversified portfolio is much less likely to be adversely affected by localised downturns.

Not having a property investing strategy

Investing in real estate is significant. You want to obtain the best return on your investment because it can be one of your largest in life. An investment strategy enables you to begin investing in real estate and accumulate several properties.

Generally speaking, investing in real estate requires trade-offs. Although they are easier to buy, less expensive houses provide lesser returns. Obtaining the funds to purchase a more expensive house is more difficult, but the returns are better. There are various methods to enter the real estate market, depending on how much you have saved for a down payment.

Obtaining a loan may be made simpler if a close relative is prepared to serve as a guarantee. But, you have to pay back the loan since failing to do so puts at danger not just the property you are purchasing but also the property that secures your loan.

Fractional ownership is an option if you don’t want to pay for everything yourself. In this scenario, you purchase shares in a single property and will be entitled to a fair portion of the capital gains and rent upon the property’s sale. You will only receive a portion of the profits, so while it may be a less risky option to get into the real estate market, your earnings will be lesser or your rate of return will be slower.

Overlooking rental demand

Accurately gauging rental calls is critical for ensuring consistent apartment profits. Misjudging this may cause extended vacancies and economic pressure.

Rental demand can vary widely depending on region and belongings kind. Conducting thorough studies on neighborhood apartment markets facilitates you in understanding the call for and set practical apartment expectations. This guarantees your own home remains occupied and profitable.

Poor property management

You’ve made the investment, but the work doesn’t stop there. Neglecting proper property control can result in a host of troubles, from troubled tenants to deteriorating asset prices.

Maximising your investment

Consider these alternatives:

- Engage a professional property supervisor

- If self-handling, educate yourself on landlord duties and tenant rights

- Implement structures for normal property inspections and upkeep

Good asset management ensures your investment stays in pinnacle circumstances and maintains to generate the choicest returns.

Inadequate knowledge of local market conditions

Comprehending the local market dynamics is crucial for achieving success in real estate investment. The fluctuations in the economy, rental rates, supply and demand, and other factors can have a big effect on the profits of your investments. Spend time conducting in-depth market research and keeping up with any changes or events that might have an impact on your investing choices.

Neglecting legal and tax considerations

Ignoring legal tax obligations can result in severe penalties and reduce your return on investment. Staying in compliance with the law is important.

Property investments come with legal taxes required. Consultation with legal and tax professionals ensures that you understand and comply with these obligations. Proper legal and tax procedures can improve the quality of your investments and protect you from unexpected liabilities.

There may be tales of fraudulent real estate transactions, including fictitious documentation. Because of this, paperwork is the most important component of a real estate transaction. Furthermore, a lot of people make the error of not reading the entire paperwork, which can cost them money and property. Examine the property documents carefully to be sure they are authentic.

Lack of long-term vision

Maximising your investment

To keep an extended viewpoint:

- Establish attainable objectives for your real estate holdings.

- Review your plan often and make any necessary adjustments.

- Keep up with industry developments, but don’t let every story get to you.

- Take your time and exercise patience to see your investments increase.

- Recall that seasoned real estate investors consider decades rather than days.

Final thoughts

Avoiding these common mistakes can significantly improve your chances of success in the property investment game. By doing your research, staying rational, and seeking professional advice when needed, you’ll be well on your way to building a robust and profitable property portfolio.

Remember, every successful investor was once a beginner. Learn from others’ mistakes, stay informed, and don’t be afraid to seek guidance from property investment consultants and strategists. With the right approach, property investing can be a powerful tool for building long-term wealth and securing your financial future.

At The Investors Agency, we find you...

The best returning properties that your portfolio needs.

WHAT OUR CLIENTS THINK OF US

Trustindex verifies that the original source of the review is Google. My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency.Trustindex verifies that the original source of the review is Google. Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth.Trustindex verifies that the original source of the review is Google. This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon!Trustindex verifies that the original source of the review is Google. An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably.Trustindex verifies that the original source of the review is Google. We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property.Trustindex verifies that the original source of the review is Google. Awesome and straight forward . Efficient!!!! TIA is the best!!!!Trustindex verifies that the original source of the review is Google. working with Josh was a good experience. Highly recommend them with your property goals.Trustindex verifies that the original source of the review is Google. It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more