New vs. Established Properties: Which Holds Better Investment Value in 2025?

When deciding on a property investment, one critical question arises: should you invest in a new property or an established one? Both options offer distinct advantages and challenges, and understanding these is essential to making a well-informed decision. As we move into 2025, the property market continues to evolve, with shifting trends in buyer preferences, government incentives, and rental demand. This blog explores both sides of the debate, helping investors weigh their options while highlighting how we can guide you through the process.

Understanding new and established properties

Before diving into the comparison, let’s define these two property types:

New properties – These include recently built houses, apartments, or off-the-plan developments. They typically feature modern designs, advanced amenities, and energy-efficient features.

Established properties – These refer to older homes or units that have been previously owned and occupied. They often boast larger land sizes, classic architecture, and mature landscaping.

Advantages of investing in new properties

Tax benefits

One of the significant benefits of investing in new properties is the tax advantages attached to them. New properties attract higher depreciation allowances, whereby an investor can claim the wear and tear on the building and its fixtures. This lowers taxable income, making new properties attractive to those seeking to invest tax-efficiently.

Modern appeal and high demand

Tenants prefer new properties because of their modern designs, energy-efficient features, and updated amenities. This often translates to strong rental yields and lower vacancy rates. However, in 2025, the Australian rental market shows signs of regional variability. While some areas continue to experience strong demand, others, particularly those with a higher concentration of new developments, may face rental market stabilisation or slower rent growth. Investors should assess local rental demand dynamics carefully before committing.

Government Incentives

In 2025, the Australian government continues to support property buyers with initiatives such as the First Home Owner Grant (FHOG) and stamp duty concessions for new builds in several states. However, these incentives vary by state and are subject to ongoing changes. For example, reforms to stamp duty schemes in New South Wales and Victoria may impact buyer affordability. Investors must stay informed about the specific policies applicable in their intended investment areas to maximise benefits.

Increased marketability

When selling or renting a new property, investors benefit from its modern appeal. Buyers and tenants alike are drawn to the fresh, clean appearance of a recently built home. New properties also comply with current safety standards, such as fire alarms and emergency exits, further enhancing their marketability.

Low maintenance costs

The construction standards followed in new homes are higher, with good quality materials and updated building codes, minimising the risk of costly repair work in the short term. New homes often come with various warranties, including structural guarantees ranging from 7 to 10 years. This gives investors confidence in investing without the worry of paying for repairs.

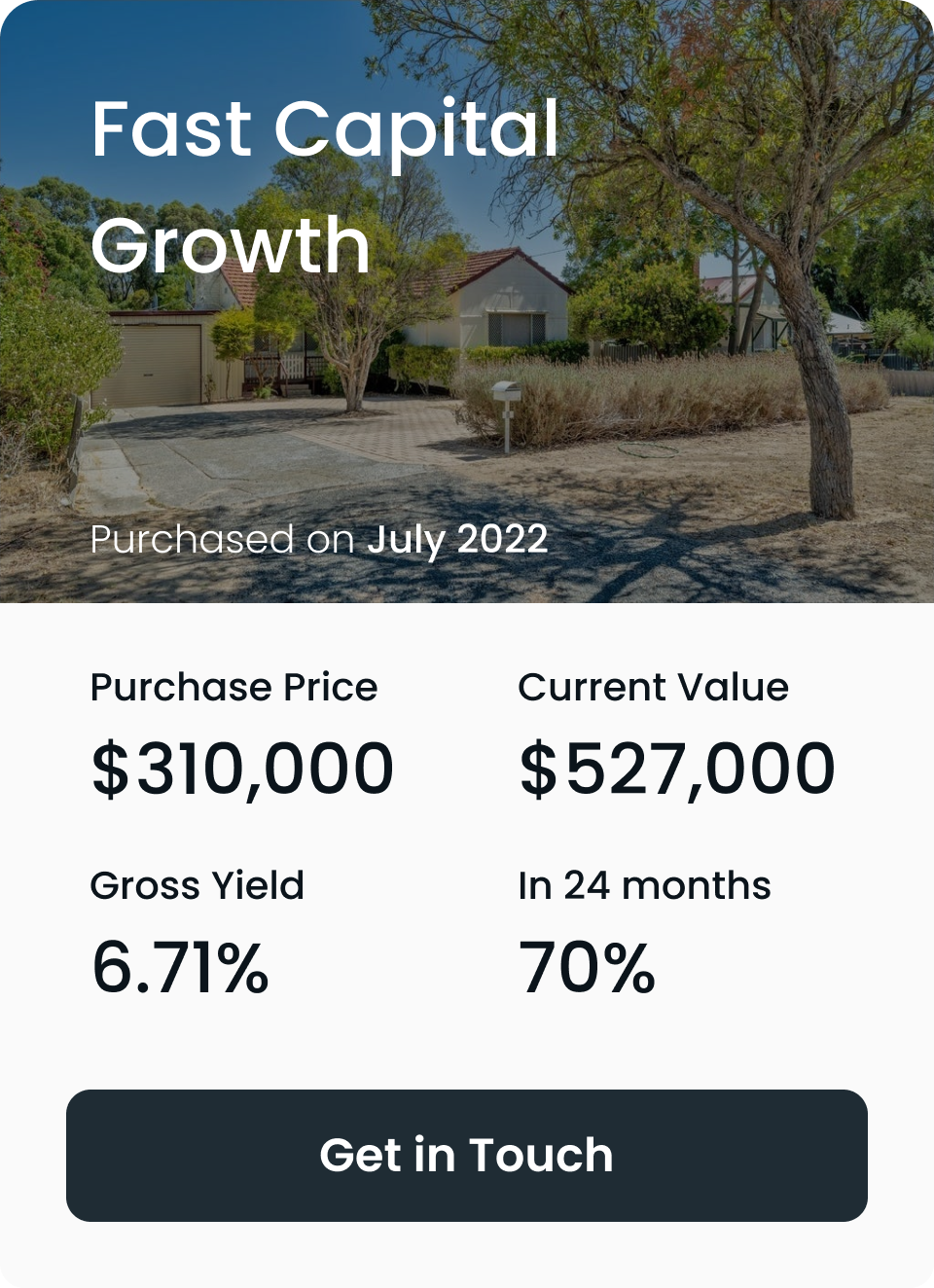

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Challenges of investing in new properties

Premium purchase prices

New properties, especially off-the-plan developments, come with a price premium. Developers typically price their projects to cover their profit margins, marketing expenses, and extra costs. This often means the upfront costs are higher compared to purchasing an existing property in the same location.

Risk of over-supply

The latest developments, especially those in outer suburban areas, face a potential risk of oversupply in Australia. This can lead to reduced yields, higher vacancy rates, and slower capital growth. However, recent trends show a slowdown in new construction projects, particularly apartments, which might mitigate oversupply risks in some regions. Australian investors should carefully research local market conditions to identify areas with balanced supply and demand.

Potential for depreciation

Whereas existing properties tend to appreciate over time, new ones can initially depreciate, especially if there is weak demand in that region. The value of a new property might dip for the first few years, similar to when purchasing a new car. This is because new houses leave little room for renovation or upgrades to improve their value. As a result, flipping may be less feasible with new builds.

Initial rental challenges

Although new properties are an attractive proposition, there can be initial challenges in letting if the local rental market is saturated. Tenants may not be willing to pay premium rent solely because a property is new, especially when they can find older alternatives at cheaper rates.

Advantages of investing in established properties

Prime locations with established infrastructure

Established properties normally lie in a matured neighbourhood, usually with schools, hospitals, shopping areas, and ready public transportation. The neighbourhoods in such cases often attract renters as well as homebuyers because of accessibility and other convenience. Suchneighbourhoodss are especially attractive to families and young individuals who have settled in some of the urban suburbs due to the blending of good amenities and appeal to living.

Proven capital growth history

When investing in established properties, investors can analyze historical data on capital growth in the area. This provides a reliable indication of the property’s potential for appreciation. Unlike new developments, which may take years to show trends, established neighbourhoods often exhibit steady growth due to their popularity and limited availability.

Potential for renovation and value addition

Established homes usually come with some renovation or upgrade opportunities to increase the market value of the property. For example, good planning in renovating a place by updating the kitchen or bathroom or even landscaping significantly increases both rental income and resale value, making this an excellent strategy for maximum returns.

Newer developments

Many older properties come with larger land sizes compared to newer developments. The value of land tends to appreciate over time, making it a crucial factor in long-term property investment. Investors can benefit from potential subdivision opportunities or simply hold the property as land values rise.

Challenges of investing in established properties

Higher maintenance and renovation costs

This tends to be older homes where there is more wear and tear. Plumbing, electrical, roofing, and structural might demand immediate attention. Renovations or repairs can be pricey in case the property has not been well maintained by past owners.

Limited tax benefits

Established properties offer less tax incentives than new ones. For instance, the depreciation benefits on older properties are much lower, and you cannot claim deductions for the construction or fixtures of the building if they are more than a certain age.

Competition for prime locations

Since the established properties often lie in sought-after places, there usually is significant competition from other buyers such as homebuyers and investors. The prices will thus be a bit steep, and a bargain would be hard to find.

Old designs and features

Older homes may not possess modern features sought by today’s renters and buyers, such as open-plan layouts, energy-efficient appliances, or advanced security systems. This can make them less competitive in the rental market unless upgraded.

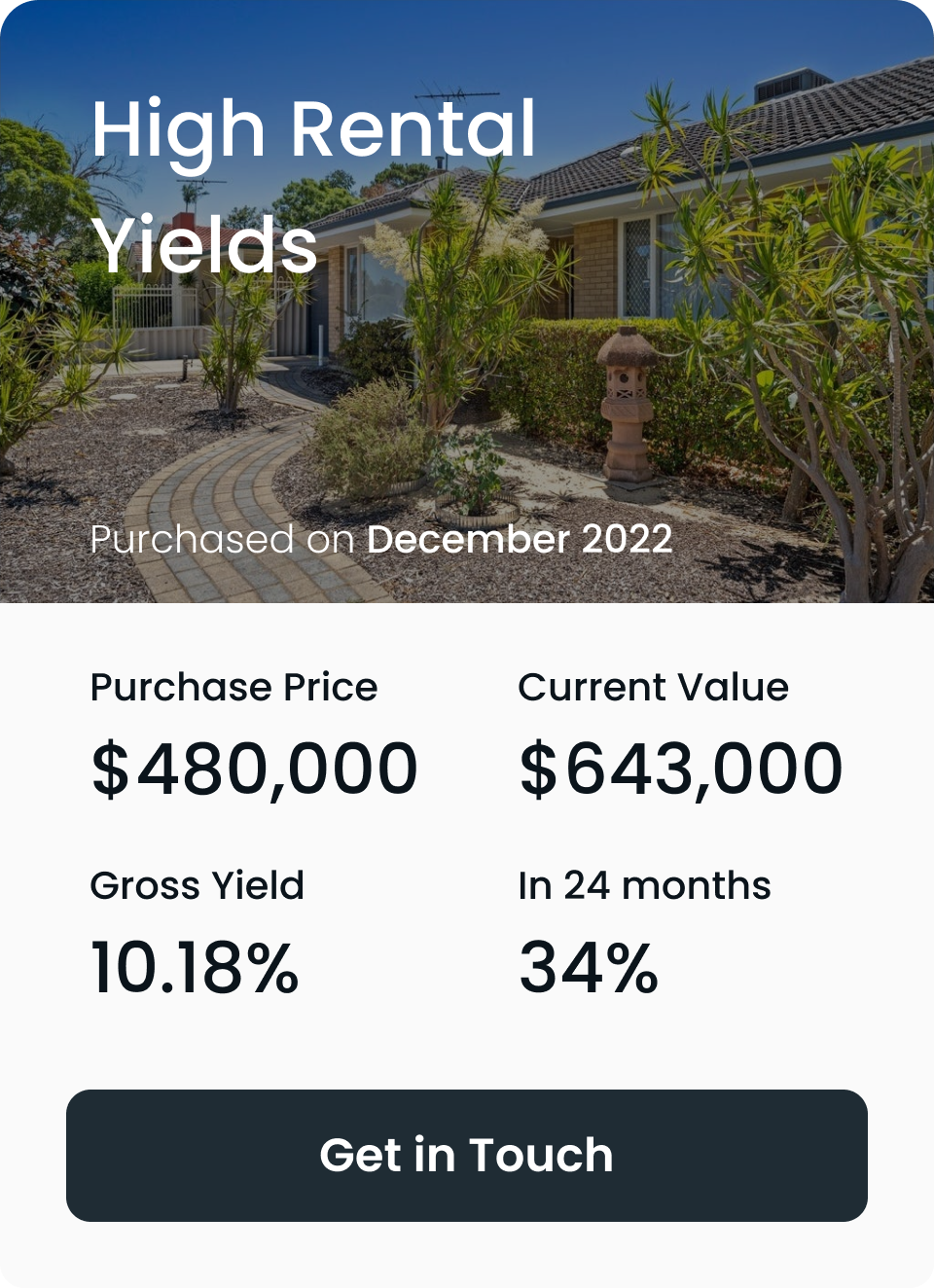

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Key considerations when choosing between new and established properties

Deciding whether to invest in new properties or established properties is a significant decision that requires careful thought. Both types of properties have their advantages and challenges, and the right choice often depends on your financial goals, investment strategy, and market conditions. Here are some key considerations to help you decide:

Your investment goals

The first step in making a decision is understanding your investment goals. Are you focused on long-term capital growth, or is your priority generating strong rental yields? New properties may offer better tax benefits and tenant appeal, while established properties are often situated in areas with proven growth potential. Aligning your choice with your financial objectives is crucial.

Location and growth potential

Location is a critical factor when choosing between new and established properties. New properties are often built in developing suburbs with planned infrastructure, while established properties may be located in prime, inner-city areas with proven growth histories. Researching the local property market and understanding the area’s growth potential is essential to making an informed decision.

Tax benefits

New properties provide attractive tax benefits, including depreciation on the building and its fixtures. These benefits can significantly reduce your taxable income, making new properties a more appealing option for some investors. While established properties offer fewer depreciation benefits, they may deliver higher rental yields or capital growth depending on their location.

Maintenance costs

Tenant demand

2025 Market Trends Favoring New and Established Properties

New properties in 2025

Established properties in 2025

By 2025, established properties in inner-city or historically high-performing areas would still be safe investment options because of the proven record of appreciation of such property. Existing properties in these areas continue to be worth more because of the land’s scarcity in established suburbs, giving solid returns for investors. Many buyers and tenants remain inclined toward the established properties for their charm and unique characteristics, especially when they happen to be located in desirable suburbs with history and good amenities.

How we at The Investors Agency can help

Personalised guidance

Extensive market knowledge

Access to exclusive opportunities

Maximising your returns

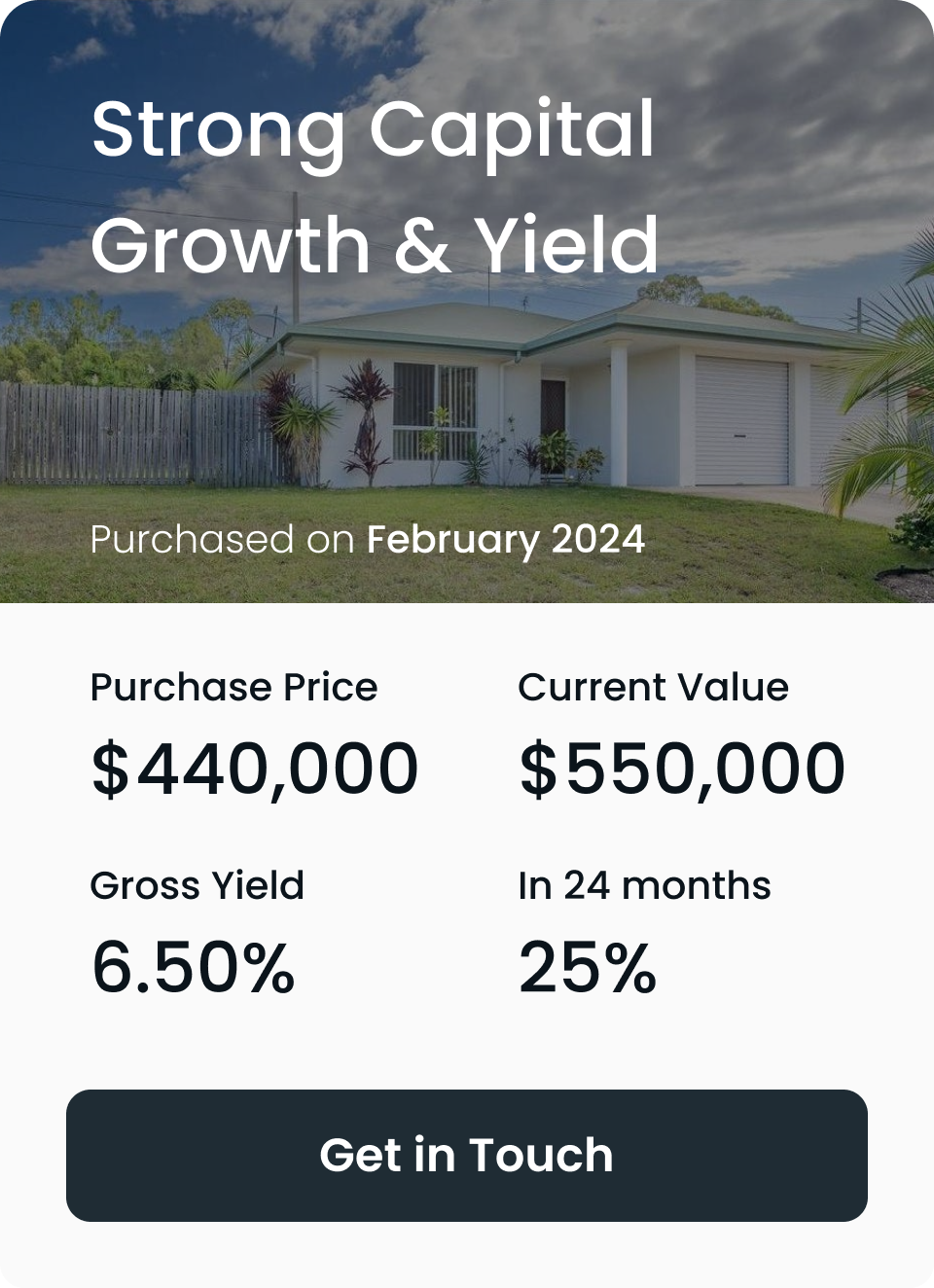

With our expertise and data-driven insights, we maximise your return on investment. Whether you’re looking to secure a new property in a growth suburb or identify a high-yield established property, we ensure every decision adds value to your portfolio.

Conclusion

New and established properties each provide their unique benefits and it depends on what investment goals you have, the budget, and the market conditions that may be prevailing. Now that trends for 2025 point towards both types of investments, it is an opportune time to invest. The right guidance ensures informed decision-making, taking advantage of exclusive opportunities when you partner with The Investors Agency. With the experience of The Investors Agency, you can confidently go out into the market, close high-value deals, and reach your financial goals.

Frequently Asked Questions

What is a tenanted property, and how does it differ from a vacant property?

What should I consider before buying a tenanted property?

How can The Investors Agency help with tenanted property investments?

Can I increase rent on a tenanted property immediately?

At The Investors Agency, we find you...

The best returning properties that your portfolio needs.

WHAT OUR CLIENTS THINK OF US

Trustindex verifies that the original source of the review is Google. My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency.Trustindex verifies that the original source of the review is Google. Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth.Trustindex verifies that the original source of the review is Google. This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon!Trustindex verifies that the original source of the review is Google. An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably.Trustindex verifies that the original source of the review is Google. We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property.Trustindex verifies that the original source of the review is Google. Awesome and straight forward . Efficient!!!! TIA is the best!!!!Trustindex verifies that the original source of the review is Google. working with Josh was a good experience. Highly recommend them with your property goals.Trustindex verifies that the original source of the review is Google. It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more