How Do You Buy an Investment Property?

Purchasing investment real estate necessitates thorough planning, budgeting, and wise judgment. To optimize returns, it is imperative to comprehend your investment property goals, evaluate the property market, and select the ideal location. Financing must be obtained, extensive due diligence must be done, and the best terms must be negotiated during this process. Following purchase, good property management by property manager will contribute to long-term capital growth and a consistent rental income stream. You can make well-informed decisions that support your financial future by adhering to a systematic approach.

Step 1: Understand your investment goals

Identifying your investment strategy is the first step to the investment property purchase. Are you looking to make rental income in the short term while allowing for long-term capital growth? If the answer is yes, your property investing approach should reflect these goals. Also, take a moment to think about your risk tolerance and borrowing power for home loan repayments. By constraining your investment property journey decisively, a clear path emerges from that point on through to the property purchase.

Step 2: Research the market

It is essential to conduct property search before investing in rental properties. Examine patterns in rental yield, property prices, and demand for rentals in various locations. Examine suburbs that have room to grow, keeping an eye out for elements like local amenities and infrastructure development. You will be better able to spot properties with great investment property tips if you have a thorough understanding of the current market value.

Step 3: Determine your budget

Determining your budget precisely is crucial when buying an investment property. This entails evaluating your financial situation, taking into account your savings, prospective rental income, and loan qualification. Aspects like stamp duty, legal fees, property taxes, property management fees, and ongoing maintenance costs should all be taken into account. You can make sure you’re financially ready for the long-term management of the property by creating a reasonable budget.

Step 4: Choose the right location

The success of your investment property depends on location. Look at areas with high rental demand, close to schools, public transport, and shopping centers, and likely future development potential. A investment property well located is not only an attraction factor for tenants, but it will also appreciate steadily over time, capital-wise, and this is a key step on your property investment journey.

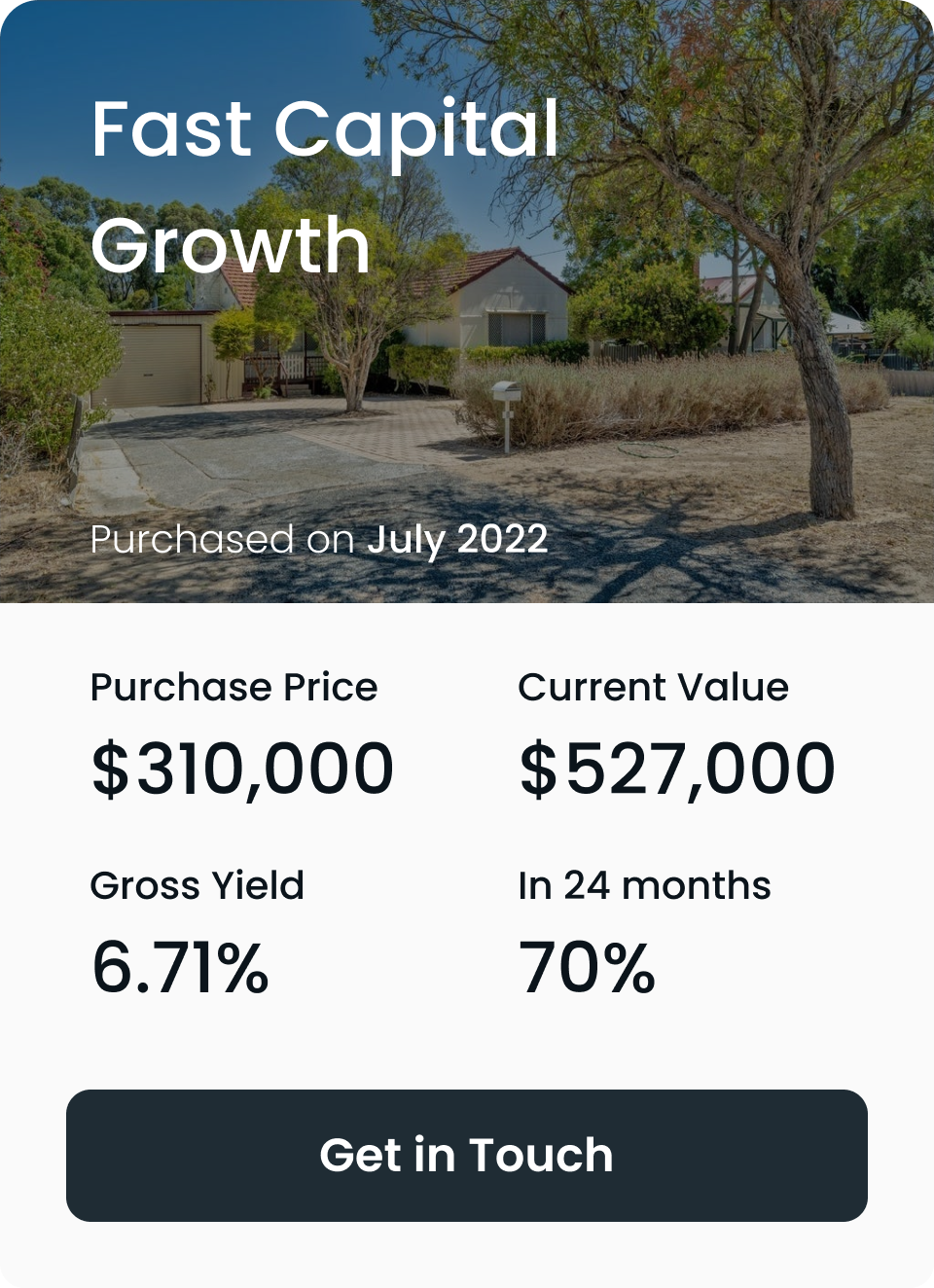

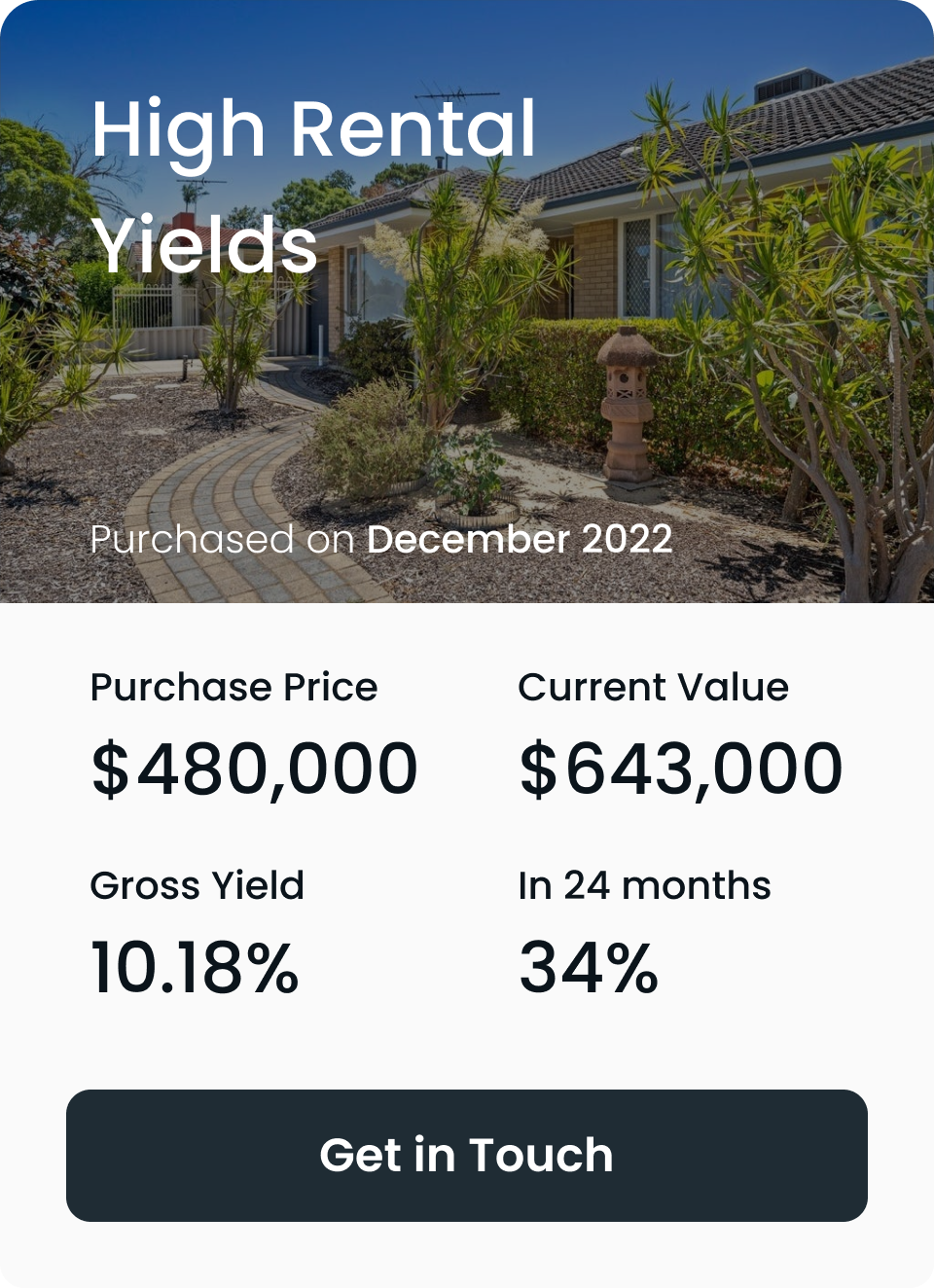

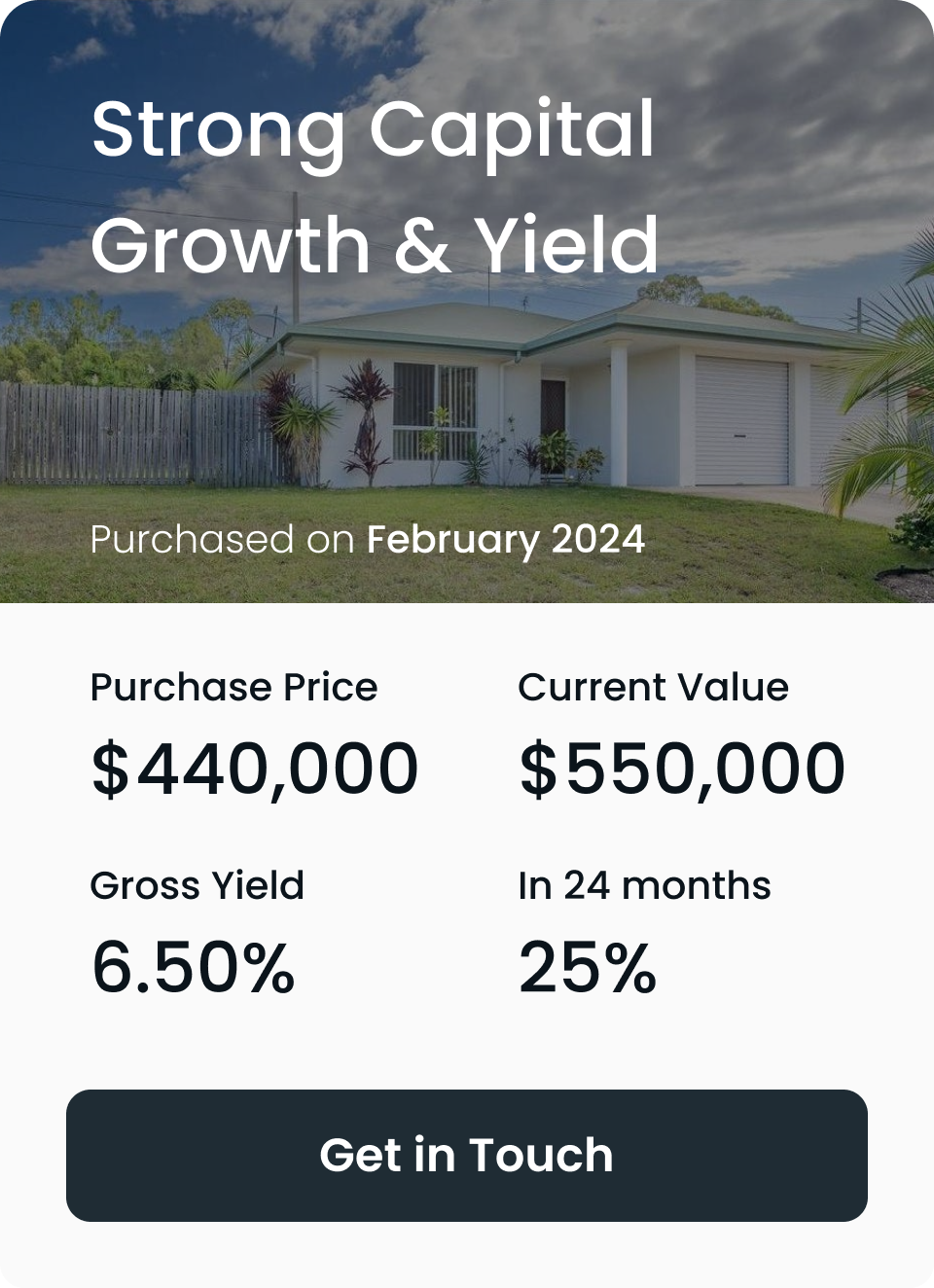

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Step 5: Secure financing

Once you have chosen your investment property, you need to get your finances in order. You should look for alternative investment loans and get a financial advisor or mortgage broker who would be able to find the right investment home loan for you. Your long-term returns are going to be heavily influenced by the interest rates and all the terms that a loan carries with it, along with the options of how you pay back. Before you make any offer, make sure you check your borrowing costs and borrowing power.

Step 6: Conduct property due diligence

Do extensive due diligence before closing on your investment property purchase. Inspecting the structure and pests as well as the legal status of the property and any outstanding debts are all included in this. Any possible problems that might lower the property value or appeal as a rental must be found. Making an informed decision now will help you avoid expensive surprises down the road.

Step 7: Make an offer and negotiate

The next step is to make an offer and negotiate after you’ve found a property that suits your needs. Based on your investigation into the market value of the property, make a fair offer first. To obtain advantageous terms, be ready for counteroffers and engage in strategic negotiation. The negotiation process can go more smoothly if you work with a property lawyer or seasoned real estate agent.

Step 8: Close the deal

Signing the contract, transferring money, and finishing all legal paperwork are all part of the closing process. To make sure all required documentation is timely and accurate, it’s critical to collaborate closely with your financial and legal advisors during this phase. You will formally own the property once the transaction is completed, and you can then concentrate on optimizing its profits through property management.

Step 9: Property management and maximizing returns

The better management of investment property maximizes investment returns. Whether you manage the property personally or hire a property manager, it is only by ensuring good maintenance of the property, satisfactory tenants, and collection of rent on time that will impact long-term capital gains and cash flow. Scrutiny of performance from time to time helps optimize total rental income and ensure the best returns on your investment property.

Conclusion

Planning the purchase of an investment property requires a clearly defined, engaging strategy. Every step is imperative, from setting investment goals to tidying up the property for maximum returns. Conduct your research, select an ideal location, arrange investment loans, and manage the property properly so that your investments are smart and fruitful, oriented toward the attainment of long-term capital growth and tax benefits or tax deductions.

Frequently Asked Questions

How much deposit do I need for an investment property?

Is it still worth buying an investment property?

How do investment properties make you money?

What to look for when buying an investment property in Australia?

What type of property is best for the first investment?

Are investment property loans easy to get?

At The Investors Agency, we find you...

The best returning properties that your portfolio needs.

WHAT OUR CLIENTS THINK OF US

Trustindex verifies that the original source of the review is Google. My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency.Trustindex verifies that the original source of the review is Google. Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth.Trustindex verifies that the original source of the review is Google. This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon!Trustindex verifies that the original source of the review is Google. An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably.Trustindex verifies that the original source of the review is Google. We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property.Trustindex verifies that the original source of the review is Google. Awesome and straight forward . Efficient!!!! TIA is the best!!!!Trustindex verifies that the original source of the review is Google. working with Josh was a good experience. Highly recommend them with your property goals.Trustindex verifies that the original source of the review is Google. It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more