How Does Negative Gearing Work

Negative gearing is a popular but often misunderstood investment strategy, especially in property investment. At The Investors Agency, we’re here to help you understand how negative gearing works with an investment property. This guide will show you how to refine your financial strategy to achieve maximum gains through your investments.

Understanding negative gearing

Negative gearing occurs when the rental income generated from an investment property is less than the expenses of owning that property. These other expenses include mortgage interest, maintenance costs, and property management fees. These are the miscellaneous costs tied to maintaining that property. When this net income is negative, it results in a net rental loss, and the investment is termed as a negatively geared property. It is important to keep the property attractive as it will significantly improve its demand on the market.

In this negative gearing strategy the costs of owning an asset, for example, a rental property, exceeds the income it generates. This creates a tax loss. However, this tax loss can be offset against other income, which will significantly reduce your overall tax bill. The idea behind this property investment strategy is to eventually sell the asset at a viable profit more than the initial losses it incurred and generate long-term capital gains.

How does negative gearing work?

For investors who own negatively geared investment properties, negative gearing works as a tax benefit. When an investor’s property operates at a loss, the government allows this loss to offset the investor’s income. This will significantly lower the amount of income tax that the investor needs to pay. By deducting the losses associated with the investment property, investors effectively reduce their overall taxable income.

A negatively geared investment property can reduce your overall taxable income. This move will often lead to potential tax savings at the investor’s end.

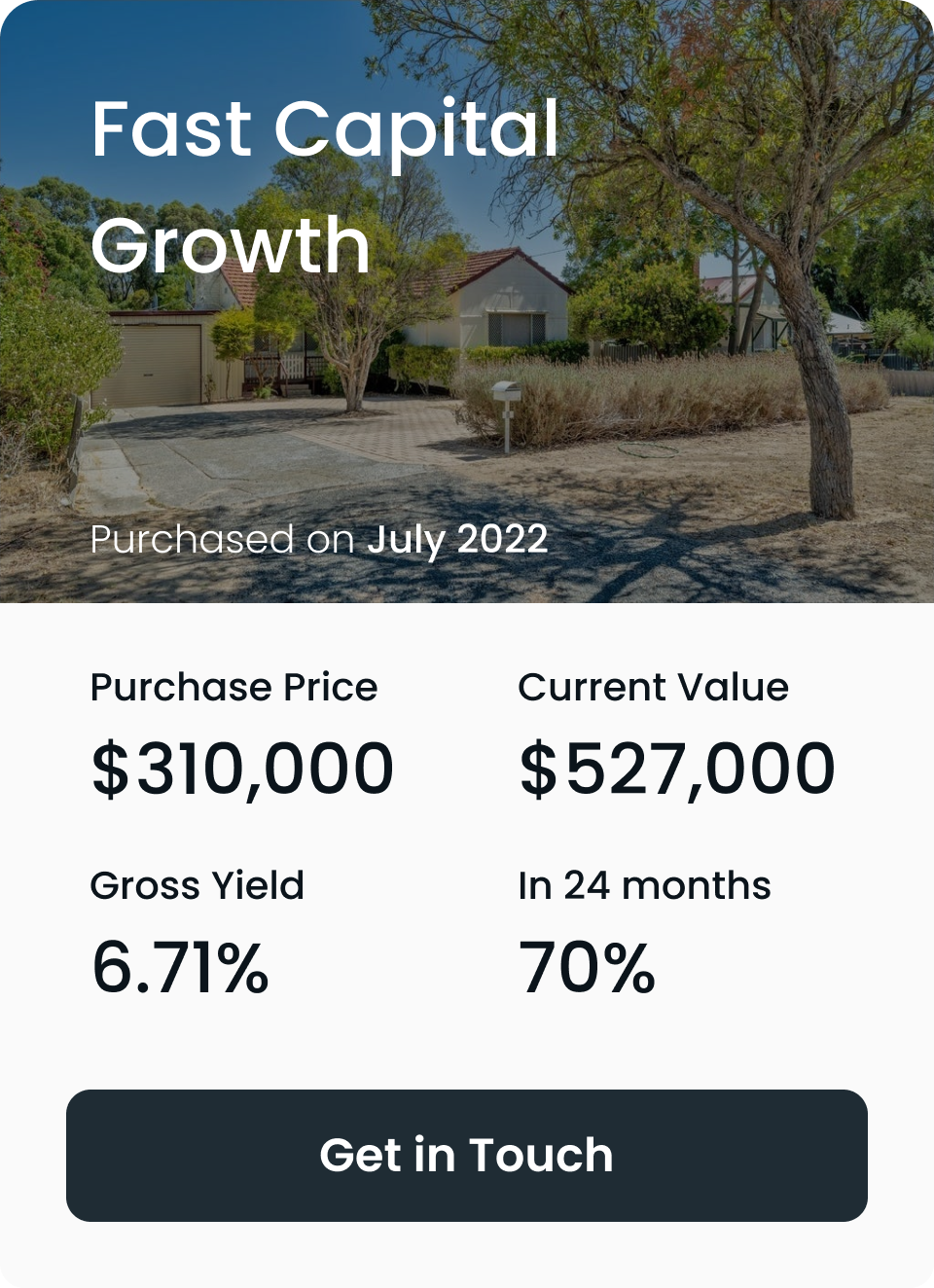

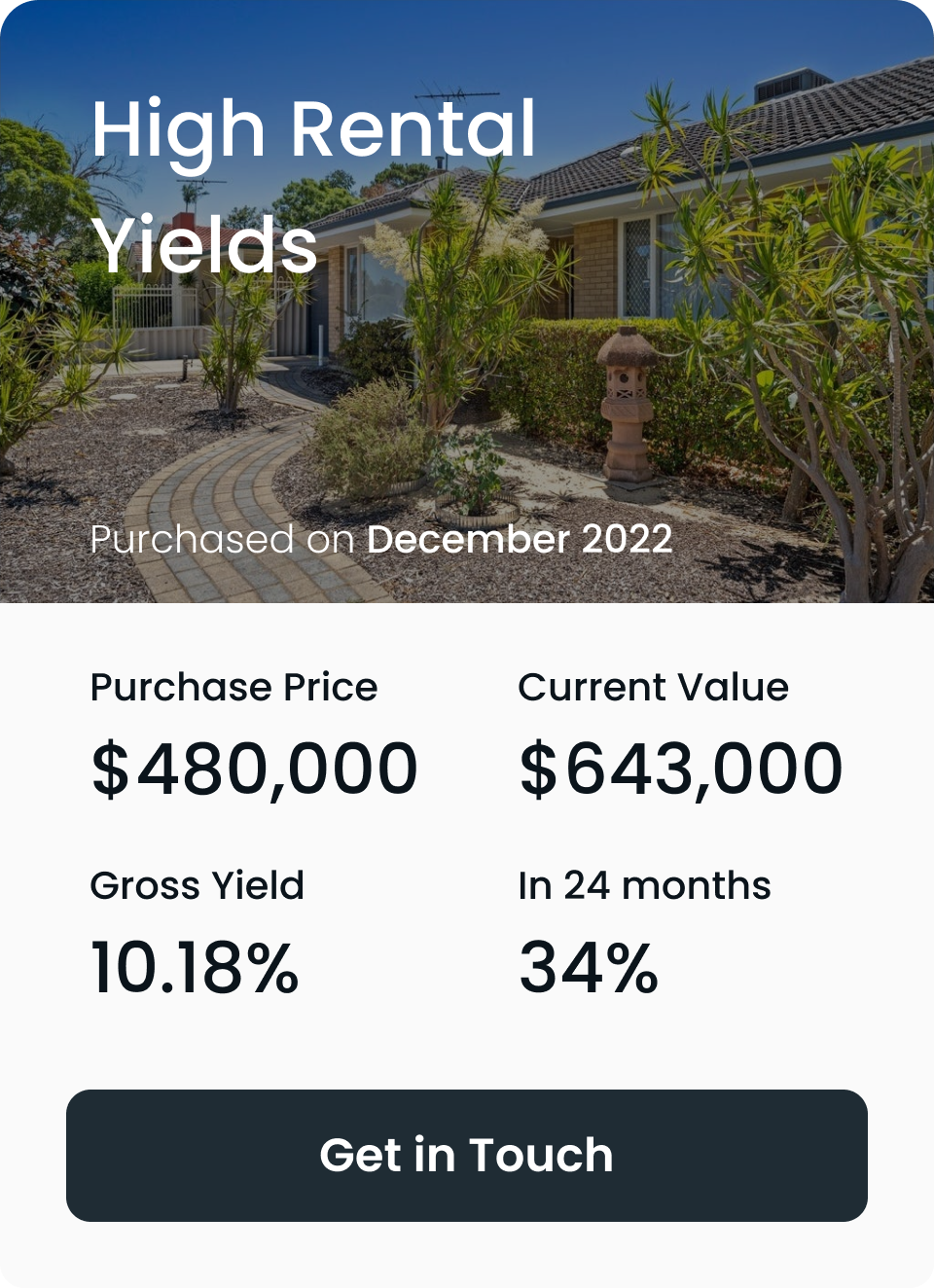

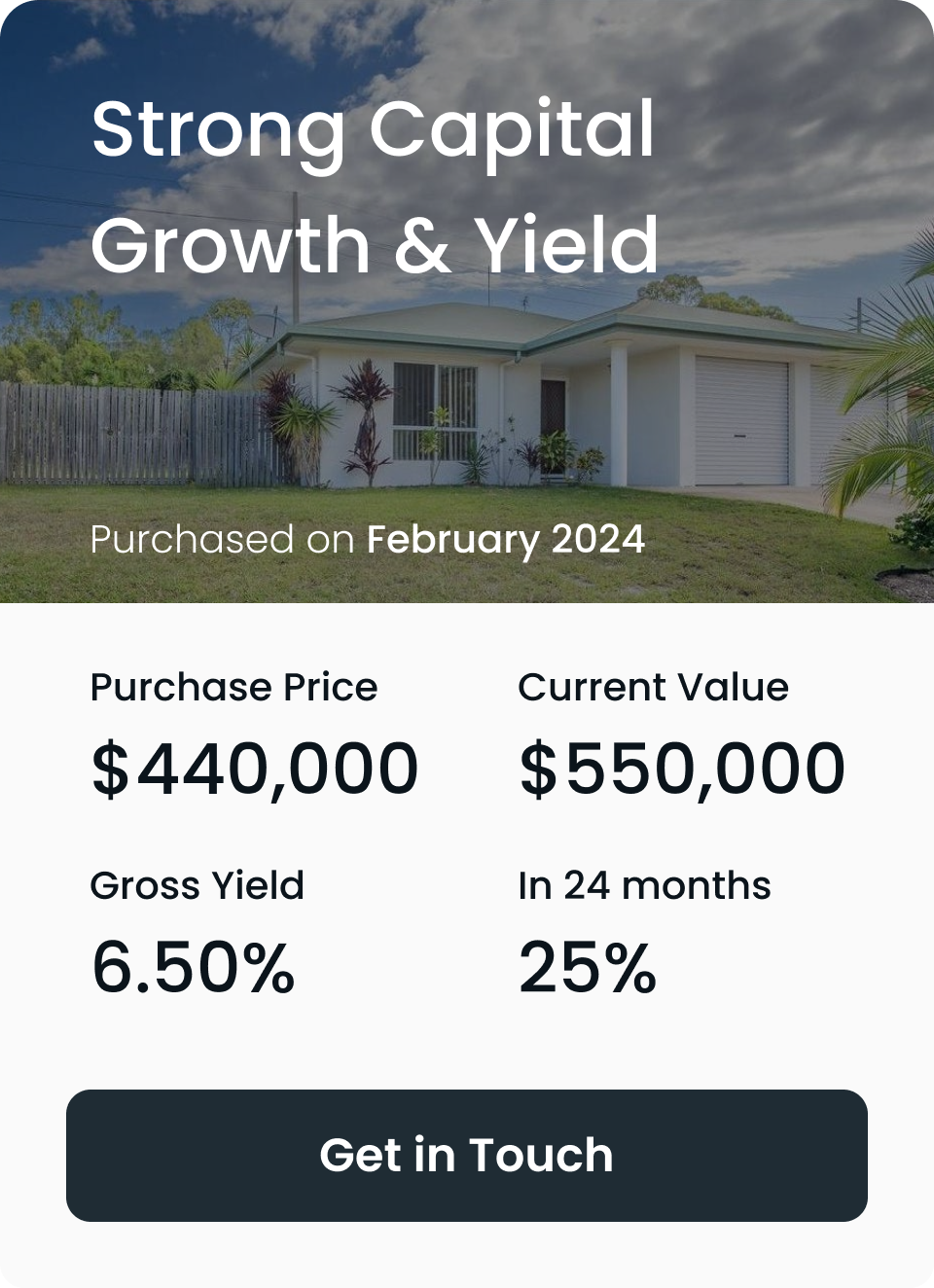

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Key components of negative gearing

Expenses and Income

Mortgage Interest

Capital Growth

Income Tax Deductions

Net Profit or Loss

Positive gearing vs. Negative gearing strategy

By the natural course of things, Positive gearing is the opposite of negative gearing. In a positively geared property, the rental income exceeds all expenses, resulting in a net profit. This extra income is added to the investor’s overall taxable income, and they may need to pay tax on it.

We at The Investors Agency craft strategies that have unique advantages for you. Negative gearing is beneficial for investors looking to offset losses for tax savings and anticipating long-term capital growth, while positive gearing offers immediate additional income but typically lacks tax benefits.

Why use negative gearing

Potential tax deductions

Potential for capital gains

Property market conditions

Market conditions play a significant role. In markets with increasing property values, negative gearing may be more attractive. However, if the market declines, the risk of incurring a loss increases. Keeping in mind the ongoing market trends and conditions will impact the property investing patterns of the investors, it is essential to consult a financial advisor regarding the course of action. Investments in rental property or residential property investments are subject to tax laws.

Enhanced cash flow for high-income earners

Tax laws and negatively gear

Claiming tax deduction

Impact on taxable income

Managing a negative gearing property

It is essential to understand what it takes to manage a negative gearing property:

- Repayments – Paying interest on the home loan or investment loan is a significant expense and it varies depending on interest rates. Investors must look out for the trends in interest rates to match their interest repayment routine.

- Property Management and Corporate Fees – Property management incurs additional costs, which can be deducted from taxable income.

- Maintenance – Regular maintenance and fees like council rates can be significant. These are also deductible, helping to lower overall taxable income.

Conclusion

While negative gearing can offer substantial tax benefits, it also comes with financial risks. Investors aiming for long-term capital growth may find negative gearing worthwhile, especially if property values are likely to increase. However, changes in interest rates, fluctuations in market conditions, and individual personal circumstances should all be taken into account.

We at The Investors Agency help you understand the investment strategy like that of negative gearing which can be a powerful strategy to minimize tax payable and maximize potential returns for you.

At The Investors Agency, we find you...

The best returning properties that your portfolio needs.

WHAT OUR CLIENTS THINK OF US

Trustindex verifies that the original source of the review is Google. My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency.Trustindex verifies that the original source of the review is Google. Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth.Trustindex verifies that the original source of the review is Google. This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon!Trustindex verifies that the original source of the review is Google. An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably.Trustindex verifies that the original source of the review is Google. We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property.Trustindex verifies that the original source of the review is Google. Awesome and straight forward . Efficient!!!! TIA is the best!!!!Trustindex verifies that the original source of the review is Google. working with Josh was a good experience. Highly recommend them with your property goals.Trustindex verifies that the original source of the review is Google. It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more