How Do You Choose the Best Areas for Property Investment?

Choosing the right area for property investment is crucial because it can significantly impact your financial success and offer you strong growth potential and consistent rental returns. Making informed decisions about location can make the difference between a profitable investment and a costly mistake.

Location is paramount in property investment. It affects rental demand, property value growth, and overall investment success. Understanding the significance of location helps investors make strategic decisions, ensuring their investments yield the desired returns.

What is Property Investment?

Types of Property Investments

- Residential Properties: These include single-family homes, apartments, and townhouses. They are popular among investors for their steady rental demand and potential for capital growth.

- Commercial Properties: These include office buildings, retail spaces, and industrial properties. They offer higher rental yields but come with more complex management and higher risks.

- Mixed-Use Properties: These combine residential and commercial spaces. They offer diversification and can be highly profitable if managed well.

Factors to Consider When Choosing an Area

Location and Position

- Importance of the Suburb or Area: Desirable suburbs often have better amenities, lower crime rates, and higher demand, leading to steady capital growth and consistent rental income.

- Proximity to Amenities: Properties close to schools, parks, public transport, and shops attract more renters and buyers, ensuring higher demand and better returns.

- Noise Levels and Traffic Flow: Properties in quieter areas with less traffic are more appealing to tenants and buyers, ensuring lower vacancy rates and higher rental yields.

- Future Development Potential: Areas with planned infrastructure and development projects can see significant property value increases, making them attractive for investment.

Price and Affordability

Investing in affordable areas with substantial growth potential can yield significant returns. “Bridesmaid” suburbs, which are adjacent to high-demand areas, often present excellent opportunities for investors.

These suburbs, while more affordable than their high-profile neighbours, frequently offer similar amenities and have considerable untapped growth potential.

For instance, an investment property in a bridesmaid suburb might provide the same access to good schools, parks, and shopping centres as a nearby prestigious suburb but at a fraction of the cost.

This relative affordability, coupled with potential for substantial capital appreciation, makes these areas particularly attractive for investors. The key is to identify these promising suburbs early, before their prices rise to match those of their more famous counterparts.

Population Growth and Demographics

Population growth is a critical driver of property demand. Areas experiencing a surge in population typically see increased demand for housing, which in turn drives up property values and rental rates.

When investing, it is essential to consider both current and projected population growth.

For instance, regions undergoing significant infrastructural developments or those attracting major employers often witness an influx of residents. Additionally, aligning the property type with the area’s demographic profile ensures higher demand.

Family-oriented suburbs benefit from properties with multiple bedrooms, spacious living areas, and child-friendly amenities.

Conversely, inner-city areas with a high concentration of young professionals may favor modern apartments with amenities like gyms and communal spaces.

Understanding these demographic trends allows investors to select properties that meet the needs of the local population, thereby ensuring consistent demand and strong returns.

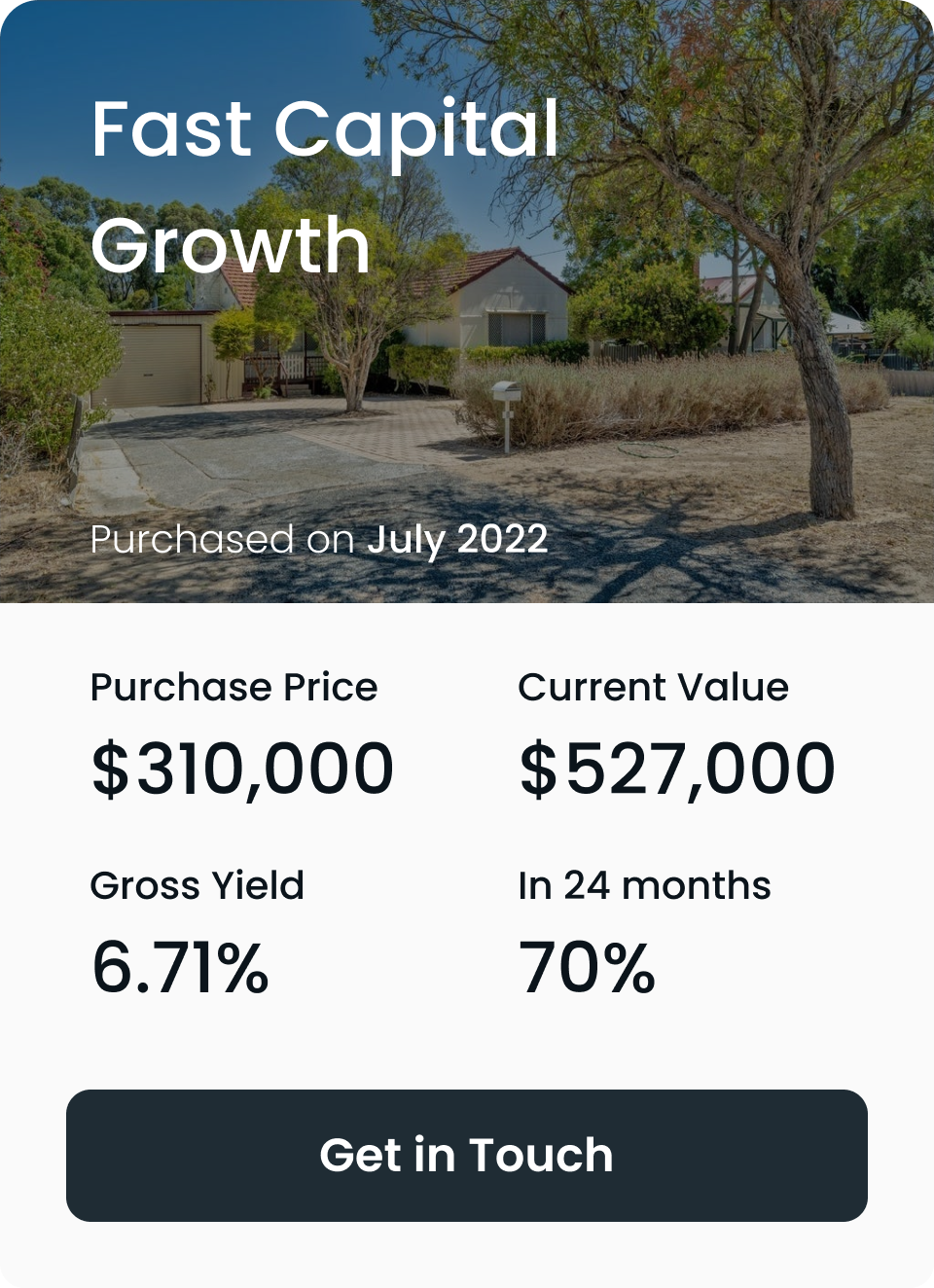

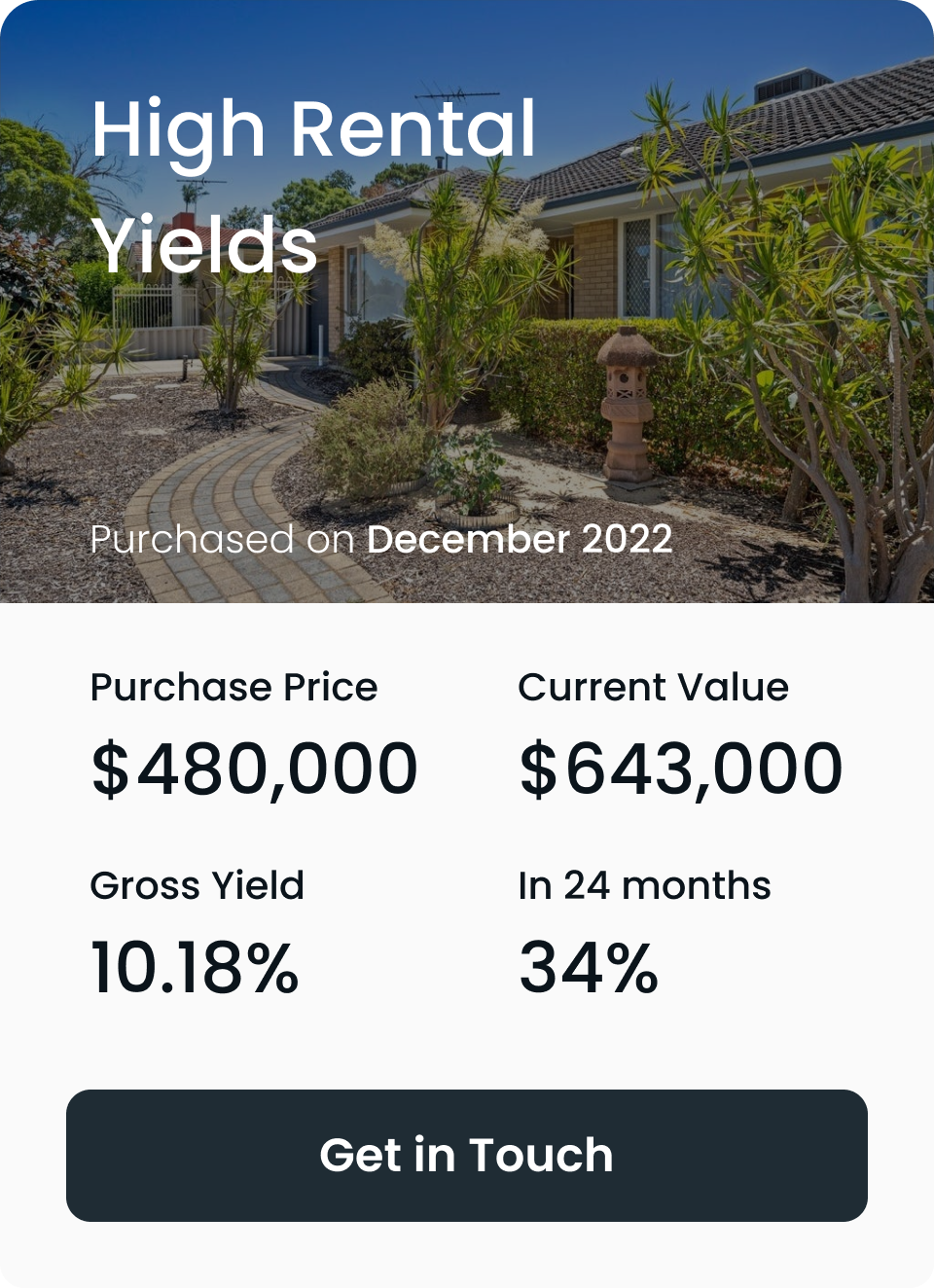

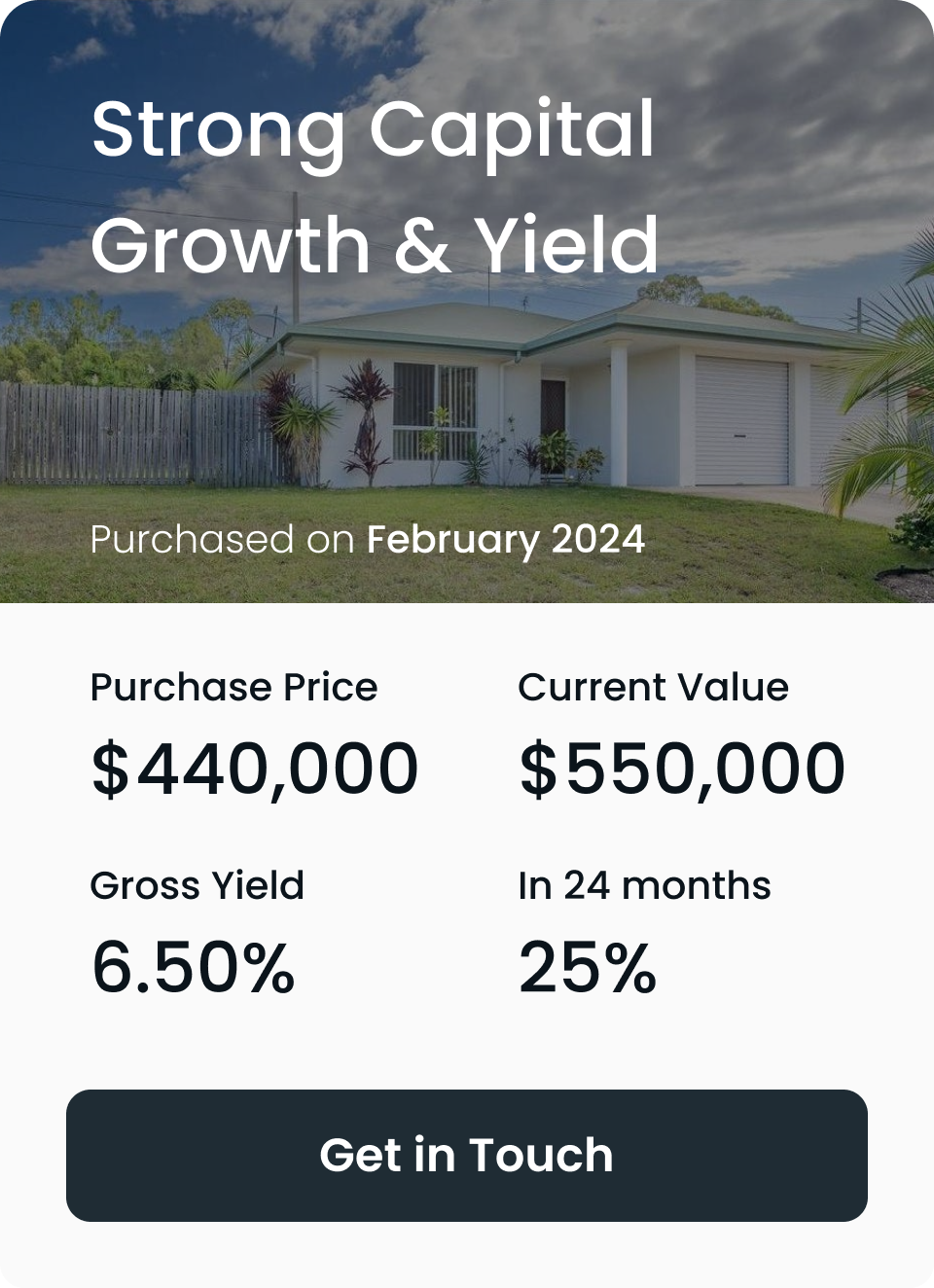

Do you have $85,000 saved in cash or equity?

Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth

properties in Australia's strongest property markets.

Do you have $85,000 saved in cash or equity? Start your investment journey with us

With $85,000 in savings or equity, you can begin or grow your investment portfolio with high-growth properties in Australia's strongest property markets.

Rental Vacancy Rates

Rental vacancy rates are a vital metric in assessing the health of the rental market. Low vacancy rates indicate high demand for rental properties, suggesting that most available properties are occupied.

This high demand is advantageous for investors as it translates to steady rental income and reduced periods of vacancy.

Typically, a healthy rental market has vacancy rates between 2% and 3%, ensuring there is enough demand to maintain stable rental income without an oversupply of properties.

On the other hand, high vacancy rates, exceeding 3%, suggest an oversupply of rental properties in the area. This oversupply can lead to decreased rental income as landlords may need to reduce rents to attract tenants.

Therefore, monitoring vacancy rates helps investors avoid markets where they might struggle to find tenants, ensuring a more stable and predictable return on investment.

Days on Market (DOM)

The Days on Market (DOM) metric is a crucial indicator of buyer demand and market health. DOM measures the average number of days a property remains on the market before it is sold.

A low DOM signifies strong buyer demand, as properties sell quickly, often at or above asking price.

This indicates a robust and competitive market, which can drive property values higher. Conversely, a high DOM suggests weaker demand, with properties lingering on the market for extended periods.

This situation can lead to price reductions as sellers become more willing to negotiate.

For investors, understanding DOM trends is essential. A market with consistently low DOM is indicative of high liquidity and strong demand, making it an attractive option for investment.

Conversely, a high DOM might signal potential challenges in reselling the property or achieving the desired rental income.

Auction Clearance Rates

Auction clearance rates are a significant metric that provides insight into the health and dynamics of the real estate market. This metric represents the percentage of properties sold at auction within a specified period, typically reported weekly or monthly.

High clearance rates are a clear indicator of strong buyer demand. When auction clearance rates are high, it suggests a seller’s market where competitive bidding is common, often driving property prices upward. Buyers in such markets need to act swiftly and be prepared for intense competition.

Conversely, low auction clearance rates indicate a buyer’s market, where properties are not selling as quickly. This situation presents opportunities for buyers to negotiate better deals, as sellers may be more willing to accept lower offers to close the sale.

For investors, monitoring auction clearance rates help understand market sentiment and timing. High clearance rates can signal the right moment to sell, while low rates might suggest holding off on selling or looking for bargains.

Employment Opportunities

Proximity to employment centers is a critical factor in property investment. Areas near employment hubs attract more residents, increasing demand for housing and driving up property values. Properties located close to central business districts, industrial parks, or large commercial centers are particularly sought after, as people generally prefer shorter commutes to work.

Strong local economies with diverse job opportunities further enhance the attractiveness of an area. A region with a variety of industries and job options provides stability and continuous demand for housing.

For instance, cities with a robust mix of tech, healthcare, education, and manufacturing sectors are likely to see steady property value appreciation. This diversity ensures that economic downturns in one sector do not significantly impact the overall job market, maintaining a stable demand for housing and enhancing long-term investment returns.

Proximity to Amenities

The proximity of properties to amenities like cafes, public transport, parks, and schools significantly impacts their attractiveness and value. Properties near such amenities are more appealing to both renters and buyers, ensuring higher demand and better returns.

For example, a property within walking distance to a great cafe strip or a major public transport hub is likely to attract more interest than one located far from such conveniences.

Areas that offer a high quality of life, characterized by recreational and cultural amenities, are particularly desirable.

Parks, sports facilities, theatres, and museums contribute to a vibrant community atmosphere, making these areas more attractive to potential tenants and buyers. This higher demand translates into lower vacancy rates and the ability to charge higher rents, thereby enhancing the property’s investment potential.

Zoning and Title Type

Understanding zoning laws and title types is crucial in property investment. Zoning laws dictate what can be built on a property and its potential uses, influencing the property’s value and investment potential.

For instance, a property zoned for residential use in a predominantly commercial area might have limited appeal and lower value compared to one zoned for mixed-use or commercial purposes.

Zoning changes can either enhance or reduce property value. For example, a rezoning initiative that allows higher-density housing can significantly increase a property’s value by expanding its potential uses. Conversely, zoning restrictions that limit development can reduce a property’s appeal and market value. Therefore, investors must stay informed about current zoning regulations and any proposed changes to avoid future issues and make strategic investment decisions.

Age and Condition of the Property

The age and condition of a property are pivotal considerations for any investor. Older properties, while often available at lower prices, may require extensive maintenance and renovations. These costs can add up over time, potentially offsetting the initial savings on the purchase price.

However, for investors willing to undertake these renovations, older properties can be transformed into highly desirable homes, increasing their market value.

On the other hand, newer properties come with higher purchase prices but require less immediate upkeep, translating to lower maintenance costs in the short term.

Additionally, newer properties offer significant tax benefits through depreciation allowances, which can reduce taxable income and increase overall investment returns. These benefits make newer properties attractive to investors seeking minimal hassle and steady returns.

Floor Plan and Functionality

The floor plan and functionality of a property significantly influence its appeal to tenants and buyers. Properties with well-designed layouts that provide good natural light and efficient use of space are generally more attractive.

A functional layout ensures that living spaces are practical and comfortable.

Natural light and ventilation are critical elements of a desirable living environment. Properties with ample natural light not only feel more inviting but also contribute to the well-being of the occupants.

Good ventilation ensures a healthy indoor environment, which is particularly important in areas with warm climates. These features enhance the property’s value and make it more appealing in the market, ensuring higher demand and potentially better rental and sale prices.

Owner-Occupier Ratio

The owner-occupier ratio in a neighborhood is an important indicator of its stability and desirability. Areas with a high percentage of owner-occupiers tend to have better-maintained properties and a stronger sense of community. This stability is attractive to tenants, leading to higher demand for rental properties in these areas.

High owner-occupier ratios contribute to neighborhood quality by ensuring that properties are well-cared for and that there is less turnover of residents. This stability makes such neighborhoods more desirable for long-term investments, as steady rental demand and well-maintained surroundings help sustain property values over time.

Online Search Activity

Monitoring online search activity is an effective way to gauge real-time demand for properties in a particular area. High levels of search activity indicate strong interest from potential buyers and tenants, suggesting that the area is in demand and potentially offering good investment opportunities.

Investors can use data from real estate websites to identify hot markets where properties are likely to appreciate in value. High search activity correlates with higher property values and rental demand, providing a valuable indicator for making informed investment decisions.

Value-Adding Potential

Properties with value-adding potential offer unique opportunities for investors to enhance returns through improvements. Renovation, subdivision, or redevelopment projects can significantly increase a property’s value, providing substantial returns on investment.

Assessing the feasibility of such projects is crucial. Investors should consider factors such as renovation costs, zoning regulations, and the potential for overcapitalization. Ensuring that value-adding projects align with investment goals helps in maximizing returns while mitigating risks. Properly executed, these projects can transform an ordinary property into a highly profitable asset.

Practical Steps to Take

Research and Due Diligence

Comprehensive research helps identify areas with strong growth potential and minimal risks.

Using market analysis tools and resources provides valuable insights into property trends and investment opportunities.

Consulting Professionals

Professional advice ensures informed decisions and helps navigate the complexities of property investment.

We at the Investor’s Agency offer expertise and local knowledge, helping investors find the best properties and negotiate favorable deals.

Setting Clear Goals

Clear investment goals guide decision-making and ensure properties align with financial objectives.

Choosing properties that match investment goals ensures long-term success and profitability.

Final Thoughts

Choosing the right area for property investment involves understanding property investment basics, considering key factors such as location, affordability, rental yield, and market dynamics, and evaluating neighborhood and lifestyle considerations.

Careful planning and informed decision-making are critical to property investment success. Conduct thorough research, seek professional advice, and set clear goals to ensure your investment choices lead to long-term financial success.

At The Investors Agency, we find you...

The best returning properties that your portfolio needs.

WHAT OUR CLIENTS THINK OF US

Matt Clarke2024-08-04My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency.

Matt Clarke2024-08-04My wife and I now have three investment properties, the last two with the help of The Investors Agency. There is no comparison between the stressful and anxious experience we had purchasing our first house alone, as opposed to the confidence we felt and professionalism shown by The Investors Agency with the purchase of our second and third investment properties. Their specialist knowledge, experience, communication skills and the resources at their disposal across the country made the whole process stress free and achieved great results. We purchased the second investment property in October 22 and used the equity in that home to comfortably purchase the third investment property in August 24. If not for The Investors Agency, I never would’ve considered the property type, value and locations. They explain their reasoning which is backed up by facts. Their advice has us on the path to financial freedom and we a very, very grateful. Thank you to Bobby, Josh, Georgie and the entire team at The Investors Agency. Gaurav Saxena2024-08-04Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth.

Gaurav Saxena2024-08-04Great experience dealing with TIA, very informative and they work closely based on your needs. Little pricey but hopefully pays off with capital growth. Matt Lav2024-07-17This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon!

Matt Lav2024-07-17This was our first home purchase. My partner and I were a bit nervous about everything but TIA made everything smooth and easy to understand. Their process really is designed to take a lot of the load off you so you can go about your daily life and not be continuously stressing out about everything. We couldn’t be happier and can’t wait to celebrate with our next one hopefully soon! Ben Killen2024-07-07An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably.

Ben Killen2024-07-07An incredible service. An incredibly honest & professional team. Every part of the process is seamless. You wont find a better property purchasing experience both from an ease of use & a performance standpoint. The team is incredibly generous with their time, making sure to go over & above. A must for any Australian serious about building wealth sustainably. Ryan Johnston2024-06-24We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property.

Ryan Johnston2024-06-24We used TIA for our first investment whilst being based overseas. The professionalism and high level of communication was exactly what we needed not being locals or experts in the market. They provide a full end to end service and would highly recommend them to anyone else looking to invest in property. DJBors Channel2024-06-24Awesome and straight forward . Efficient!!!! TIA is the best!!!!

DJBors Channel2024-06-24Awesome and straight forward . Efficient!!!! TIA is the best!!!! Rahul Ramachandran2024-06-09working with Josh was a good experience. Highly recommend them with your property goals.

Rahul Ramachandran2024-06-09working with Josh was a good experience. Highly recommend them with your property goals. joseph karipel2024-05-31It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more

joseph karipel2024-05-31It's been great working with 'Investors Agency'. They're very earnest in their involvement with our customized needs to look around and get a suitable property for us. Nothing short of excellence!!Load more